by Gary Schnitkey, Nick Paulson, and Jim Baltz, Department of Agricultural and Consumer Economics, University of Illinois,

Bradley Zwilling, Illinois FBFM Association and Department of Agricultural and Consumer Economics, University of Illinois,

Carl Zulauf, Department of Agricultural, Environmental and Development Economics, Ohio State University and Bob Rhea,

Illinois FBFM Association

Current levels of futures contracts suggest that appropriate budgeting prices for 2024 crops production are $4.00 per bushel for corn and $10.50 per bushel for soybeans. Those prices would result in low returns in 2024, far lower than the last low-price period from 2014 to 2019. Much higher costs cause lower 2024 returns. Those budget price forecasts could change with unforeseen events, as does occur in agriculture. Over the next several months, estimates for returns and incomes will solidify. Still, it seems prudent to plan for much lower prices.

Corn and Soybean Prices

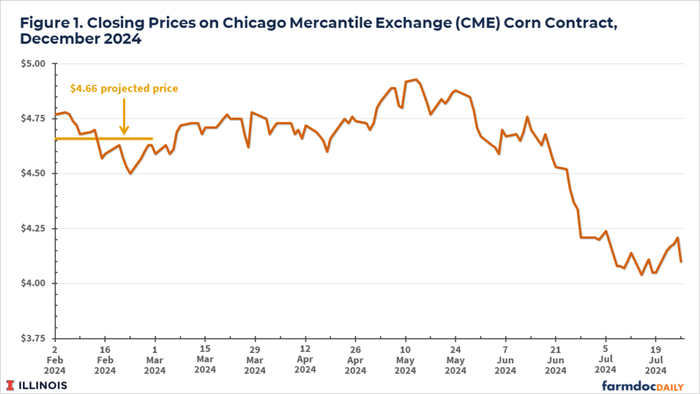

Expectations generally have been for much lower corn and soybeans prices in 2024 compared with the 2021 to 2023. In February, the projected price used to set guarantees on crop insurance was set at $4.66 per bushel for corn. The projected price is the average of February settlement prices of the December corn traded on the Chicago Mercantile Exchange (CME) and represents an unbiased indicator of prices at harvest. The $4.66 projected price is well below the $5.90 projected price for 2022 and $5.91 for 2023.

Since February, the December CME futures contract has fallen, currently trading near $4.10 per bushel (see Figure 1). This decline in price is consistent with a growing belief that yields in the U.S. will be above trend. Moreover, no significant market surprises have occurred that would either reduce supply or increase demand. In other words, a good supply of corn and roughly stable demand are leading to lowered price expectations.

The current December futures price for corn is consistent with cash prices below $4.00 at harvest, roughly $3.80 per bushel. Given usual price patterns, one expects cash prices to increase over the marketing season, and an average cash price of $4.00 per bushel for 2024 production seems reasonable.

A $4.00 price is well below recent prices. USDA reports the national market year average (MYA) price at $6.00 for 2021 and $6.54 for 2022. The 2023 marketing year will end in August, with a current forecast of $4.65 per bushel. If a $4.00 price occurs for 2024, it would be the lowest since 2019, when the market year average price was $3.56 per bushel.

Futures markets are currently suggesting roughly similar prices for 2025 for corn. The December 2025 futures contract is trading near $4.60, indicating that cash corn prices at harvest in 2025 could be in the low $4.30 range.

A similar story exists for soybeans. The 2024 projected price for soybeans is $11.55 per bushel, well below projected prices in 2022 ($14.33) and 2023 ($13.76). November futures prices have fallen since February, now trading near $10.20 per bushel. Cash price at harvest below $10 per bushel are likely, with an overall 2024 MYA price of $10.50 being an appropriate projection. Futures prices suggest continuing low prices into 2025, with a $10.80 price being an appropriate projection for the 2025 MYA price.

2024 Return Implications

Current markets are pointing to corn prices averaging near $4.00 per bushel and soybeans prices averaging near $10.50 per bushel over the next several years. Overall, the higher prices from 2021 through 2023 appear transitory, and prices are now moving to lower levels (see farmdoc daily, July 9, 2024). We may be again entering a period of lower prices like that from 2014 through 2019. From 2014 to 2019, central Illinois farmers received an average price of $3.64 per bushel for corn and $9.69 for soybeans.

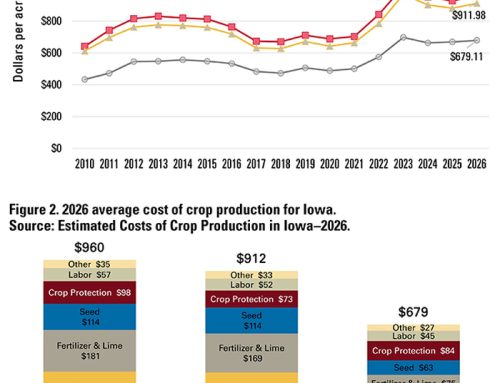

Current market price indicators of $4.00 per bushel for corn and $10.50 for soybeans are above the 2014 to 2019 averages. Still, return levels likely will be much lower than from 2014 to 2019 because of higher costs. According to Illinois Farm Business Farm Management (FBFM) data, non-land costs for corn averaged $587 per acre from 2014 to 2019 (see Revenue and Costs for Illinois Grain Corps here). Those non-land costs increased to a projected $772 per acre, an increase of $185 per acre. Non-land costs for soybeans increased from an average of $363 per acre in 2014 to 2019 to a projected $512 per acre in 2024, an increase of $149 per acre. Cash rents increased from an average of $277 per acre from 2014 to 2019 to a projected $359 per acre in 2024, an increase of $82 per acre.

We revised prices and yields in the central Illinois high-productivity budgets (see farmdoc daily, June 25, 2024) to reflect lower prices, higher yields, and some Price Loss Coverage (PLC) and Agriculture Risk Coverage (ARC) payments. Corn prices were lowered from $4.50 per bushel to $4.00 per bushel (see Table 1). Growing conditions have been good across Illinois, leading to an increase in yield from 227 bushels per acre to 234 bushels per acre. Soybean prices are reduced from $11.30 per bushel to $10.50 per bushel, while yields are increased from 72 bushels per acre to 75 bushels per acre. Also included are $5 of PLC/ARC payments. If those payments occur, they will be received in October 2025. Based on current crop conditions, crop insurance payments likely will be minimal in 2024. We also added $5 per acre to reflect modest crop insurance payments. On revenue products, lower prices likely will be offset by higher yields.

To read the entire report click here.