PRF Done Better.

Maximize Your Policy with PRM

Do you know the probability of a loss for your PRF insurance? Precision Risk Management does, and they can show you! The pasture, rangeland, forage tools help determine the highest probability for a loss payment based on historical events. Choosing the right option and intervals for PRF no longer needs to be complicated. PRM makes PRF easy and maximizes your policy!

Historical Data on Your Grids

PRM provides you up to 30 years of history showing which intervals provided a loss indemnity and which ones paid out the most.

Probability Chart

PRM shows you the probability of receiving an indemnity payment, based on the historical data.

Optimizer

Take the guess work out of which interval periods to choose. PRM’s optimizer clearly presents which interval periods could optimize your PRF insurance to cover costs when you need them most. Maximizing your payment with the correct intervals has never been easier.

Get Your Personalized Grid’s Quote

With the PRF Optimizer returns increased up to 99%.

A negative indemnity of -$1,041 turned it into a positive return of up to $7,809

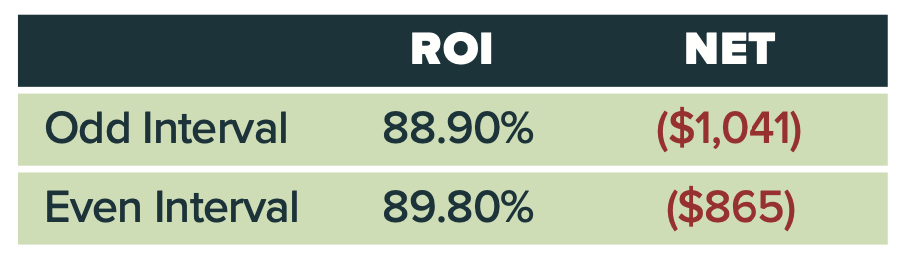

A rancher needed PRF Insurance protection but did not see it being a good investment of capital. Chosen at random, the interval periods were producing negative returns costing more in premium than indemnity.

Precision Risk Management put the policy through the PRF Optimizer to see if the area has the potential for a likely return. Three combinations of intervals with equal coverage allocation were found to create a significant return.

Without PRM

PRM’s Optimized Results