By Paul Schadegg, Sr VP Farm & Ranch Management & Real Estate, Farmers National Co., Omaha, NE

Over the past year, the topic of land market resiliency has been discussed at length. Rising interest rates, inflation, and most importantly, grain markets have continued to pressure the overall ag economy, and as one would expect, land values.

Despite these pressures ag land values have remained quite stable across most of the Midwest with some areas seeing continued strong demand for land, while others experiencing a “settling” of value.

What are the buyers’ motivating factors and market drivers maintaining these historic values of farmland?

Buyer Mindset and Opinion of Value

Understanding the buyer’s mindset provides some clarity regarding motivation to bid on land for sale. The other consideration is each buyer also has their own opinion of value for that purchase of land.

Agriculture producers continue to be the largest segment of ag land buyers. They typically focus on the benefits of operation expansion and the economics of scale to best utilize today’s farming equipment. Ag producers also view ownership of land as their “401K” or eventually as part of their retirement plan due to the historic appreciation of land value.

Land investors continue to be a growing segment of ag land buyers. This non-emotional segment of buyers looks primarily at the opportunity for return on their land investment while also appreciating the long-term growth in land value we have experienced over the past 40 years. Investors view the ownership of farmland as an asset that typically diversifies an investment portfolio.

Both the ag producer and land investor have a common focus on profitability, but their opinion of value may differ based on economics, scale of operation, and stated goals.

Supply and Demand

Land listed for sale across the Midwest has fallen nearly 25% according to industry estimates when compared to the active land market between 2021-2023. When this limited supply is coupled to the motivated buyer groups discussed above it brings clarity to why land values are maintaining their current levels. There are simply more motivated buyers than willing sellers in today’s land market supporting the “economic principle of supply and demand”.

Commodity Markets

Grain markets have traditionally been the primary driver to land values. While grain markets have experienced downward pressure over the past 12 months, worldwide demand remains strong. This demand provides a level of confidence to buyers that the current price levels could see some upward movement in the near term, improving the opportunity for return on their land investment.

Mindset and opinion of value give us great perspective into the value of land to agriculture operations in today’s market while the drivers of supply/demand and commodity markets give us clarity as to why these values are being maintained.

What should we be concerned about?

The greatest concern in my book is the ag economy. Net farm income is projected to be down nearly 4.5% in 2024 compared to 2023. This follows a decrease of 19.5% between 2022 and 2023. This economic factor alone will slow the motivation for land purchases from our largest segment of buyers, the agriculture producer. However, if motivation from producers slows it has the potential to expand buying opportunities to land investors.

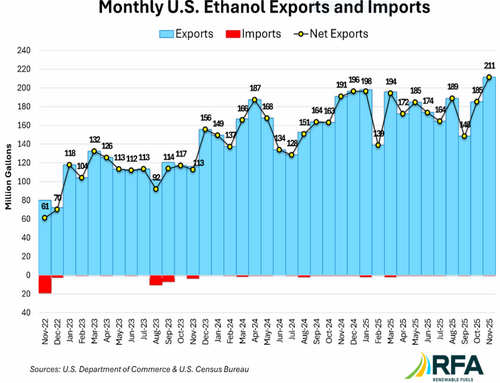

World events continue to impact the outlook for both grain imports/exports and subsequently the ag economy.

Finally, the US elections. This has been and will be quite the memorable election cycle no matter what side of the aisle you stand. While the effect this election will have on the US economy is yet to be determined, I would anticipate market volatility and the potential for a lingering impact on land value.

If you’re looking to navigate the complexities of the current land market or need expert advice on agricultural land investments, don’t hesitate to reach out to an expert at Farmers National Company. Our team is ready to provide the guidance you need to make informed decisions. Contact us today to learn more about how we can help you achieve your land ownership goals.