Source: Rabobank news release

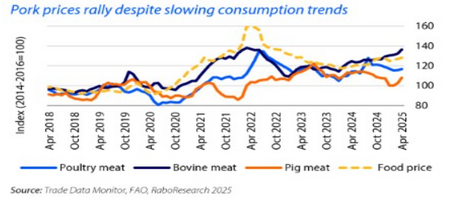

According to a recent RaboResearch report, pork prices have rebounded and remain strong despite shifting trade flows and growing economic and consumer uncertainties. Rising tensions between the US and China are creating opportunities for other suppliers, particularly the EU and Latin America.

Brazilian and European pork likely to benefit from US-China trade disruption

So far, rising geopolitical tensions have had limited impact on global pork markets, but they are likely to redirect global trade volumes in the coming months. Despite the agreement between the US and China to reduce tariffs substantially for 90 days, the added tariffs on US pork could still curtail trade.

“For China’s swine sector, this development is likely to be price supportive, while alternative suppliers like the EU, Chile, and Brazil may also benefit,” notes Christine McCracken, Senior Analyst – Animal Protein for RaboResearch. Chinese importers that previously relied on US pork are likely to face margin pressure, while US pork exporters will likely see weaker offal values. With China’s market largely out of reach, alternative markets will absorb exports at reduced prices. Heightened US-China trade tensions could also affect feedstocks, particularly soymeal. Slower US oilseed exports may reduce feed costs for US hog producers, partially offsetting export losses. “Given the uncertainty surrounding future US trade policy, investment in US pork sector expansion is expected to slow, while other regions may see slightly faster growth,” adds McCracken.

Pork price rebound amid economic concerns

Pork prices have rebounded, driven by tighter hog supplies due to limited growth in the sow herd and ongoing health and productivity challenges. The slow production response also reflects growing market uncertainty resulting from weaker economic growth prospects and the risk of trade disruptions from rising geopolitical tensions.

“We expect limited demand improvement for the rest of the year. High beef and poultry prices, along with the expected shift in consumer spending from foodservice to retail (where pork tends to perform better) may offer support,” notes McCracken. However, potential export disruptions in the US and China, combined with slower economic growth and consumer spending pressures, are likely to cap additional improvement. Despite these headwinds, the industry remains relatively well-balanced, as limited sow herd growth is expected to constrain global pork supply.

Disease challenges linger, tightening supply and disrupting trade

Herd health challenges continue to constrain production in several key regions and, in some cases, are also dampening demand. The most significant development in Q1 2025 was the reappearance of foot-and-mouth disease (FMD) in the EU – marking the first outbreak in decades – and new cases in pigs in South Korea. To control the disease, authorities in the EU established containment zones, increased surveillance, and imposed transport restrictions. Although several trade restrictions were put in place, they are gradually being lifted due to the absence of further outbreaks. Across much of Asia and parts of Europe, producers are also battling African swine fever. New cases and challenges in controlling the spread among wild boar populations are contributing to ongoing production losses and trade disruptions. Additionally, porcine reproductive and respiratory syndrome is negatively impacting pork production in parts of North America and Europe.

South American harvest keeps feed prices steady, but trade risks persist

Expectations for a strong South American harvest and good planting progress for corn and oilseeds in the Northern Hemisphere are providing tailwinds for feed cost. However, geopolitical disruptions continue to impact global grain and oilseed trade. Factors such as US dollar volatility, rising geopolitical tensions, ongoing US-China trade disruptions, and signs of a potential resolution to the Russia-Ukraine war are all influencing short-term market dynamics. Larger grain supplies and rising stock levels should help keep feed costs manageable. “Our base case scenario for commodity prices suggests relatively flat feed costs for the remainder of 2025. However, geopolitical developments and weather-related uncertainties remain key risks,” warns McCracken.