|

|---|

by Kim Schmidt, Farm Equipment magazine

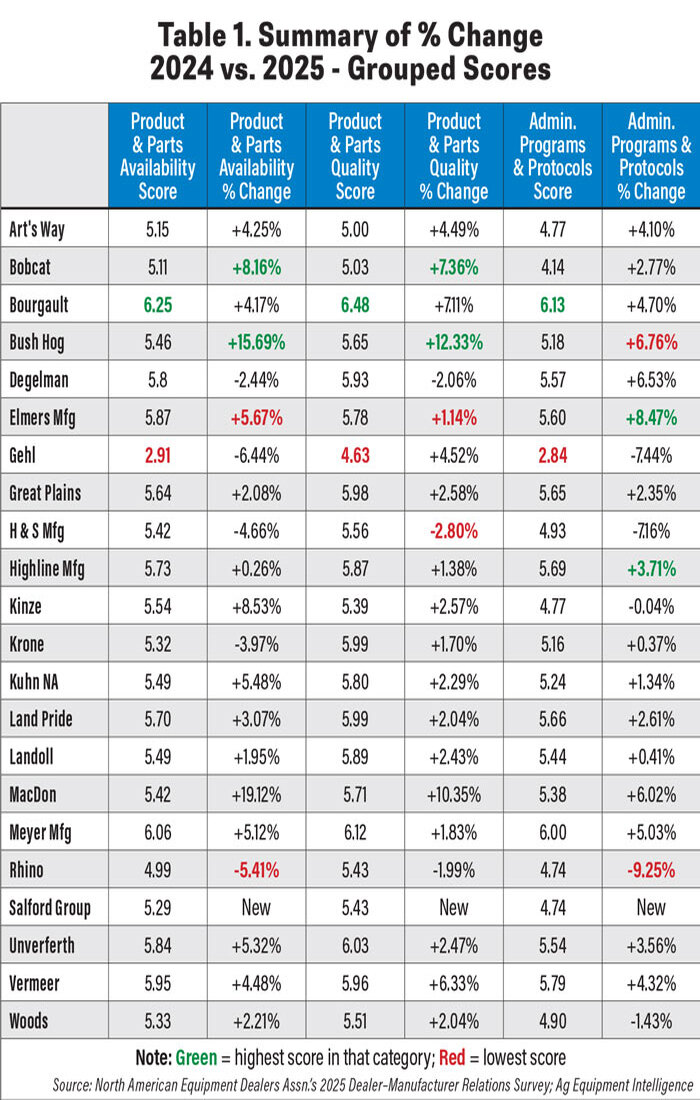

Brookfield, WI — The 2025 North American Equipment Dealers Assn. (NAEDA) Dealer-Manufacturer Relations Survey results are in and once again, it shows what dealers value most in their manufacturing partners and expectations. It also highlights who is performing best and who is moving up in the ranks, as well as those that are falling behind.

Dealers and manufacturers alike anticipate the annual survey results each summer. Over the years the report has been taken quite seriously by some manufacturers — whether their results were positive or negative. For those who do well, the results are often promoted to prospective dealers and customers. For those who don’t fare so well, concerted efforts and changes in practice are often put in place with the goal of improving their results in the years ahead.

Dealers, meanwhile, have used it as a point of reference on prospective lines or in rationalization decisions that follow mergers and acquisitions, and the occasional discussion during dealer advisory board meetings. While NAEDA does not break out results by segment (tillage, planting, etc.), dealers can examine the manufacturers in those categories when comparing suppliers.

In terms of the importance of each category to the dealers, the top 5 — Product Quality, Parts Availability, Parts Quality, Manufacturer Response to Dealer Needs/Concerns and Product Technical Support — remained the same since the 2024 report, but there were a few slight shifts lower down on the list.

Bourgault takes home the Dealer’s Choice Award in 2025 for the shortlines, with Meyer Manufacturing earning the Gold Level Award.

Company-by-Company Results

Bourgault stood out among the shortline manufacturers for the second year in a row, improving its scores in 10 categories as well as overall satisfaction. It also had the highest average mean score (6.22) of the shortlines and had the highest score in 9 out of 12 categories (Overall Satisfaction, Product Availability, Product Quality, Product Technical Support, Parts Availability, Parts Quality, Communication with Management, Marketing & Advertising Support and Manufacturers Response to Dealer Needs/Concerns).

Meyer Mfg. had the second highest average mean (6.02) score followed by Vermeer (5.85). Vermeer, Bush Hog, Great Plains, MacDon and Unverferth improved in all 11 categories as well as Overall Satisfaction. Salford gained enough dealers to be included in the report this year. MacDon on average showed the most improvement over last year.

To read the entire article click here.