What these prices mean for top-end protection

The numbers are in. The 30-day Price Discovery Period for Margin Protection (MP) and Margin Coverage Option (MCO) is officially closed.

- Corn Base Price: $4.56

- Soybean Base Price: $10.73

These prices are now locked as the “starting point” for MP and MCO policies. This sets the guarantee level that will be compared to harvest prices and county yields to determine if an indemnity is triggered.

Why These Prices Matter

MP and MCO allow you to protect a margin by incorporating area yield, commodity price, and input costs. These base prices are the foundation of your revenue and margin guarantees. They are fixed now and won’t adjust lower. That means:

- If market prices drop during harvest, your floor is already set.

- If county yields fall or input costs rise, the coverage becomes even more valuable.

The Market May Be Warning You

When looking at MP and MCO, you need to think well in advance for these protections. These policies will protect the crop being harvested in fall of 2026. Where will prices be in Nov-Dec of 2026? No one knows for sure. What we can do is compare the futures market prices of this year to illustrate commodity price drops for these policies. Here’s where futures* are currently trading for December 2025 corn and November 2025 soybeans.

| Base Price | Futures* | % Change | |

| Corn | $4.56 | $4.23 | 7.23% |

| Soybeans | $10.73 | $10.42 | 2.89% |

Both commodities are currently trading for harvest in 2025 below their MP/MCO base prices. The decline is more significant for corn, which shows a ~7% drop.

For both crops, the finalized base price gives you a stronger starting point than the market currently offers. That difference, especially in corn, could be valuable if the market continues to soften into harvest.

With MP and MCO policies, the base price is your defense line. If futures continue to drop or if county yields underperform, you could be well positioned for the insurance policy to help cover your margin losses.

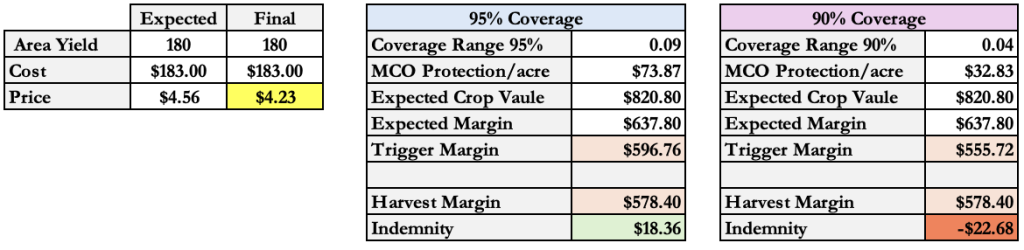

An MCO Harvest Example

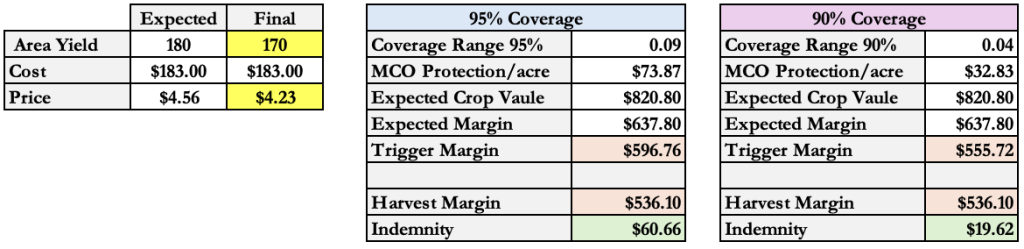

Let’s look at a scenario of what these prices and area yield could mean for a corn indemnity if we extend these future prices out as the final prices for harvest in 2026.

A county has an approved yield with 180 bushels and the base price of $5.56. If prices fall to the futures market of $4.23, an MCO policy would pay a $18.36 per acre indemnity at a 95% coverage level.

If prices fall to the futures market of $4.23 and the area yield drops by 10 bushels, an MCO policy would pay a $60.66 per acre indemnity at a 95% coverage level and $19.62 at 90% coverage levels.

What Operators Should Do Now

With the base now set, this is the time to take a specific look at how these prices apply to your operation and area:

Evaluate

- What would your county need to yield at harvest for you to trigger a claim?

- How does the 80% subsidization affect the premium you pay for MCO?

- How do you layer a Revenue Protection Policy (RP) with SCO and MCO/ECO to give full protection up to 95% levels?

These are complicated questions, and a PRM Risk Management Advisor can walk you through them based on your operation and area.

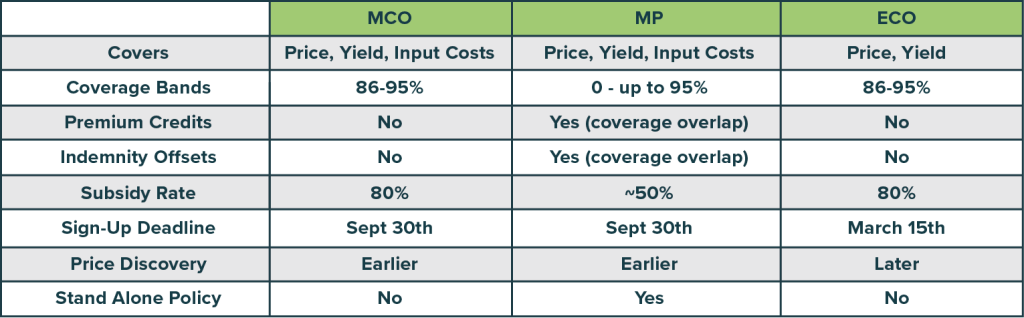

Compare Options

Choosing the right coverage isn’t just about levels. It’s about how and when that coverage kicks in. MP, MCO, and ECO may look similar at a glance, but their differences can significantly impact your bottom line. Here’s how they compare.

You can also look ahead to Enhanced Coverage Option (ECO), which uses a February 1–28 Price Discovery Period. ECO can be a useful second tool, especially if you aren’t satisfied with where the current fall’s pricing landed or want to hedge with a later market signal.

Bottom Line

It’s time to review your county yield trends, run margin scenarios, and talk with your Risk Management Advisor to determine:

- How likely is a payout under MP or MCO?

- Should you layer ECO this spring instead?

- What is the role of your RP policy and SCO under these scenarios?

This is where the overview ends and real quoting plus analysis for your operation begins. Contact a PRM Advisor today to start looking at specifics on which of these options are the best for your risk profile.

Disclaimer: This content is for educational purposes only and should not be considered legal, financial, or coverage advice. For personalized recommendations, consult with a licensed crop insurance agent or Risk Management advisor. PRM is an equal opportunity provider. The information described herein does not amend, or otherwise affect, the terms and conditions of any insurance policy issued by Clear Blue Insurance Company.