By Ryan Hanrahan, University of Illinois’ FarmDoc project

Bloomberg’s Ben Westcott reported that “China’s purchases of American soybeans appear to have stalled, less than two weeks after the US touted a wide-ranging trade truce that signaled thawing relations between the world’s two biggest economies.”

“After a flurry of orders late last month — which were the first of this season — Chinese imports of US cargoes seem to have faltered, according to traders who asked not to be identified discussing confidential information. They said they were not aware of new shipments,” Westcott reported. “The pause is fueling uncertainty over whether the biggest consumer of American soybeans will import as much as US President Donald Trump’s administration claims to expect.”

“Washington said Beijing had pledged to buy 12 million tons of soybeans by the end of this year, followed by 25 million tons annually over the next three years. China has yet to confirm the specific purchase commitments mentioned by Trump’s team, but Beijing has reduced tariffs on American soybeans and lifted import bans on three American exporters, including CHS Inc., reciprocating similar conciliatory actions from the US,” Westcott reported.

“‘Within the industry many view the reported commitment by China to purchase 12 million tons of US soybeans to be more of a diplomatic gesture than a firm trade deal,’ said Kang Wei Cheang, an agricultural broker at StoneX Group Inc. in Singapore,” Westcott reported. “China has spent the past few months buying massive amounts of South American beans in a bid to diversify its sources. Therefore, Chinese demand is expected to be lower in the coming months regardless of any trade deal with the US, according to Vitor Pistoia, senior grains and oilseeds analyst at Rabobank.”

China’s State Trader Buys Brazil Soybeans

Reuters’ Ella Cao and Lewis Jackson reported that China’s “state trader COFCO’s oilseed unit said on Monday it has signed agreements to purchase Brazilian soybeans, soybean oil, palm oil and other agricultural products, with a total volume of nearly 20 million tons worth over $10 billion.”

“The contracts with traders including ADM, Bunge , Cargill and Louis Dreyfus were signed last week at the China International Import Expo in Shanghai, COFCO Oils & Oilseeds said in a statement on its official WeChat account,” Cao and Jackson reported. “The statement made no mention of U.S. farm goods. Beijing has made modest purchases of American agricultural products, including some soybean cargoes bought by COFCO as goodwill gestures amid improving trade ties with Washington.”

China Already Dealing with Soybean Glut

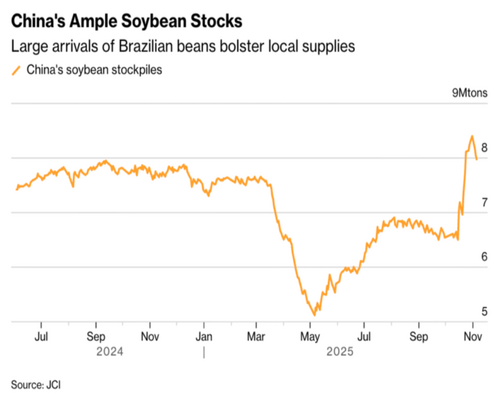

Reuters’ Naveen Thukral and Ella Cao reported that “China is grappling with a glut of soybeans after months of record imports, curbing prospects for U.S. exports despite a recent trade truce that Washington said includes a pledge by Beijing to resume heavy purchases. Traders and analysts warn that vast stockpiles at ports and in state reserves, coupled with weak crush margins, limit Beijing’s appetite for further purchases.”

“‘State firms may be waiting for margins to recover before making large-scale purchases,’ said Johnny Xiang, founder of Beijing-based AgRadar Consulting,” according to Thukral and Cao’s reporting. “‘Even with tariff waivers, margins remain negative and Brazilian beans are still cheaper.'”

“Chinese buyers sharply boosted soybean purchases from South America earlier this year, while shunning those from the United States, fearing a shortfall if the trade war with Washington dragged on, leading to oversupply,” Thukral and Cao reported. “Soybean stocks at Chinese ports reached a record 10.3 million tons on Nov. 7, up 3.6 million tons on the year, while processors, known as crushers, held 7.5 million tons, the most since 2017, data from Sublime China Information showed.”

“Physical prices for soymeal, used to fatten animals in the world’s biggest pig producer, have dropped more than 20% from an April peak in key coastal regions, to hover around 3,000 yuan ($421) a ton, Mysteel data showed,” Thukral and Cao reported. “Such areas are the northern region of Tianjin, the eastern provinces of Shandong and Jiangsu and southern Guangdong. Chinese crushers have faced losses since mid-year, with a negative margin this week of about 190 yuan a ton in the processing hub of Rizhao, and traders expect margins to stay negative until at least March.”