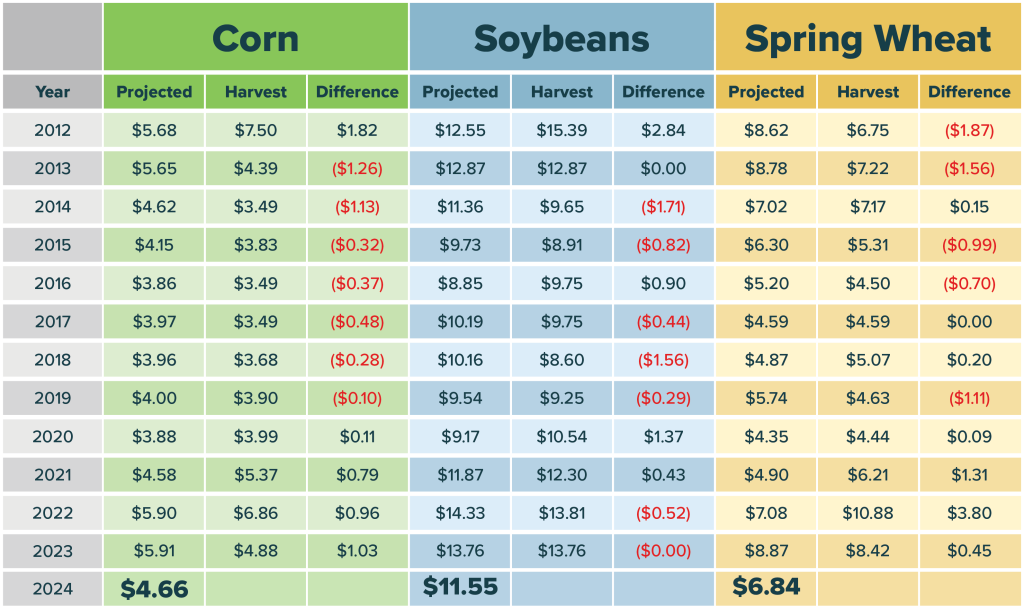

The Price Discovery Period is over and the 2024 commodity prices for crop insurance are set called projected base prices. These set the initial price of a bushel for crop insurance policies.

- Final crop insurance numbers can be finalized

- Prices still are significantly lower than recent highs

- Caution over using last year’s insurance plan without review

Lower Prices Lower Crop Insurance Guarantees

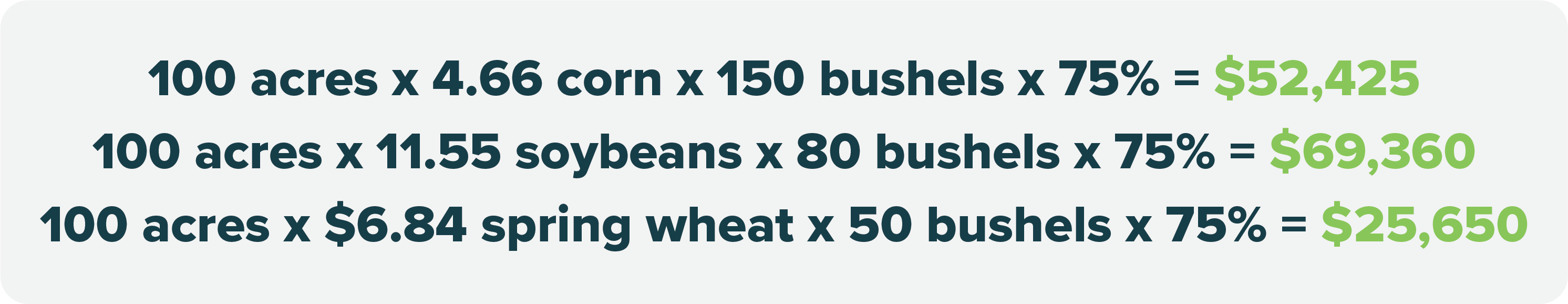

The amount of loss payment a grower could receive is determined by the base prices. The lower the base prices the lower guaranteed revenue a grower is eligible for. To calculate the guarantees, you follow the equation: Acres x Commodity Price x APH x Coverage Level. Your Risk Management Advisor will provide your guarantees and other policy information in a quote.

These prices for corn and soybeans are much closer to the base prices of 2021. Spring wheat’s base price has retreated from recent years but is still significantly higher than 2021 prices.

Caution of Copy and Pasting Last Year’s Plan

PRM recommends every year to not bring last season’s crop insurance over without a thorough risk review. In 2024, this is especially important with lower commodity prices. The lower commodity prices at the same levels are going to provide less of a safety net for growers. This means you are operating at a higher risk level and may be responsible for a loss of revenue if the crop is below expectations.

Looking at corn as an example, in 2023 the base price was $5.91. That provided a much higher level of guarantee with a difference of $11,148.

How to Protect Your Revenue with Lower MPCI Guarantees

Crop Insurance can be thought of in tiers. The base tier is the Multiple Peril Crop Insurance (MPCI). This tier has the choice of coverages such as Revenue Protection and Yield Protection. The next tier will cover up where the MPCI coverage ends up to 86% of losses.

For many operations, Enhanced Coverage Option (ECO) may be a useful risk management tool in 2024. ECO covers 86% to either 90% or 95% of county revenue, depending on which level of the coverage the grower selects.

Harvest Price Changes

The projected base price set in February is only the first of two discovery periods for some policies. A Harvest Price Discovery Period will set a second price using the same CBOT process of averages. Most states’ Harvest Price Discovery Periods for corn and soybeans are in October. Crop insurance policies using projected prices will take the higher of the two in determining guarantees and other policy information.

Finalize Your Policy Before March 15th

Now is the time to finalize your crop insurance. The deadline is March 15th, 2024.

It is vital to have the right partner to guide you in creating a plan. Precision Risk Management provides our customers with a full crop insurance risk management strategy tailored specifically for their operation. Every operation has different needs and requires a different strategy.

Other Commodity Base Prices Announced

| Crop | Projected Price | Volatility Factor | Sign-Up Deadline |

| Spring Barley (Kansas) | $4.27 | 0.13 | 15-Mar |

| Spring Barley (Other States) | $4.34 | * | 15-Mar |

| Canola (Spring) | $0.203 | 0.15 | 15-Mar |

| Canola (Spring Rapeseed) | $0.273 | 0 | 15-Mar |

| Corn – All (Non-High Amylose) | $4.66 | 0.19 | 15-Mar |

| Cotton | $0.83 | * | 15-Mar |

| Grain Sorghum (Texas) | $4.67 | 0.18 | 15-Mar |

| Grain Sorghum (Other States) | $4.67 | 0.19 | 15-Mar |

| Oats | $3.38 | 0.19 | 15-Mar |

| Popcorn | $0.2097 | 0.19 | 15-Mar |

| Soybeans | $11.55 | 0.15 | 15-Mar |

| Sunflowers – Oil | $0.238 | 0.21 | 15-Mar |

| Sunflowers – Confectionary | $0.288 | 0.21 | 15-Mar |

| Wheat (Spring) | $6.84 | 0.14 | 15-Mar |

*Volatility factor varies by state