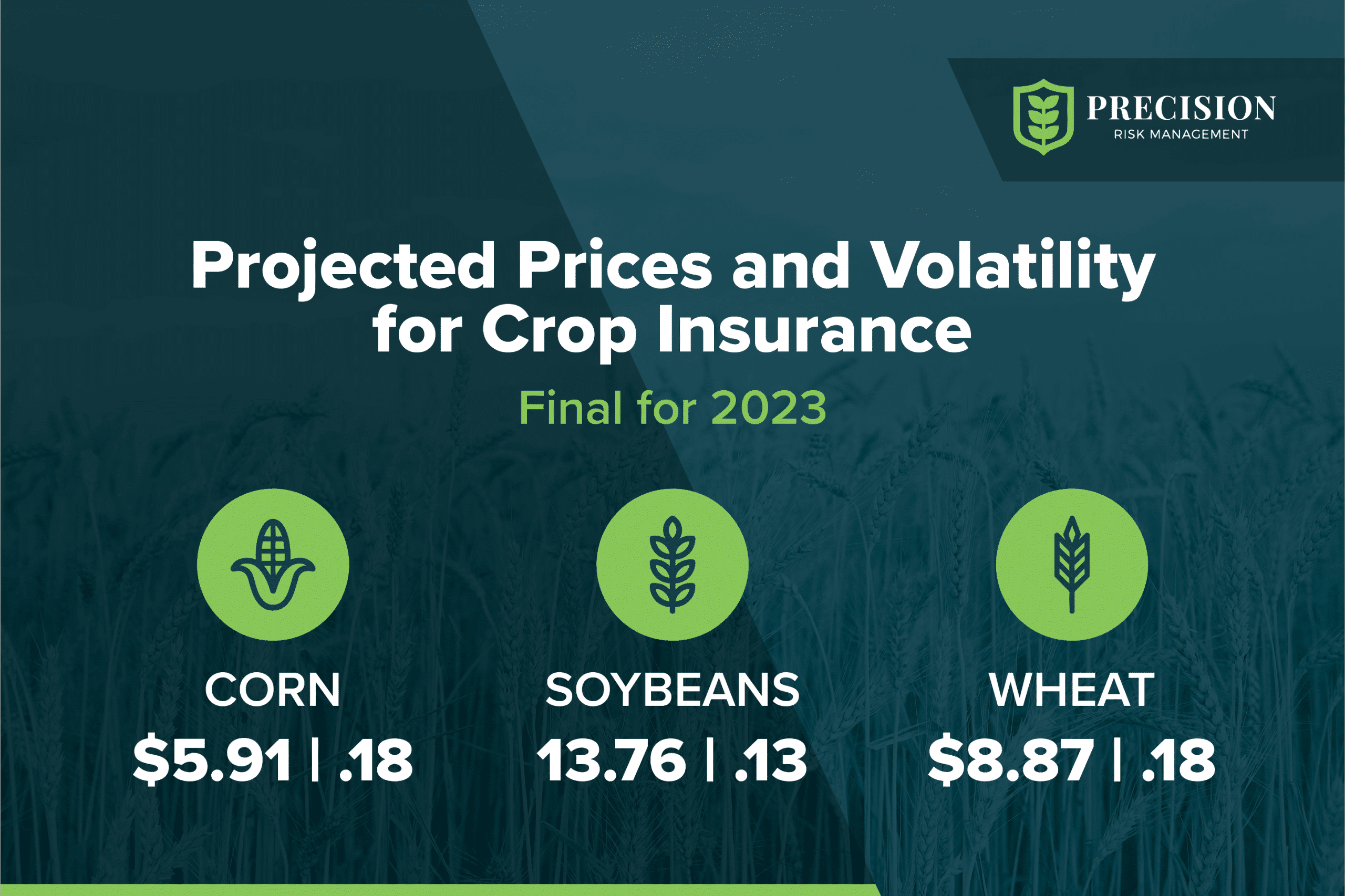

The Price Discovery Period is over and the 2023 commodity prices for crop insurance are set. These set the initial price of a bushel for crop insurance policies.

Key Take Aways

- Final crop insurance numbers can be finalized

- Prices still are higher than recent history

- Premiums on average are slightly lower than 2022 with reduced volatility

High Prices Create High Guarantees

The amount of loss payment a grower could receive is determined by the base prices. The higher the base prices the more guaranteed revenue a grower is eligible for. To calculate the guarantees you follow the equation: Acres x Commodity Price x APH x Coverage Level. Your Risk Management Advisor will provide your guarantees and other policy information in a quote.

Corn and wheat prices are at a slightly higher level than in 2022. Soybeans, on the other hand, have a $0.57 drop. This will drop Liabilities for soybeans by around 4%. All three crops are or are close to historic highs for base prices.

Lower Volatility Reduces Premiums

Despite corn and wheat having higher prices than in 2022, premium prices are lower. The volatility factor is significantly lower than last year. This lower volatility factor is actually reducing average premium prices. Precision Risk Management is seeing premium decreases of around 15% for corn and 16% for soybeans from 2022 at the same levels.

Harvest Price Changes

The projected price set in February is only the first of two discovery periods for some policies. A Harvest Price Discovery Period will set a second price using the same CBOT process of averages. Most states’ Harvest Price Discovery Periods for corn and soybeans are in October. Crop insurance policies using projected prices will take the higher of two to determine guarantees and other policy information.

The high base prices create large guarantees, but it creates a potential for a price drop. The harvest price will determine if a loss for revenue protection (RP) plans. No one knows if the harvest price will be lower or higher than the base prices. We do know these projected base prices are at higher levels than the 10-year averages. Over the course of these 11 years, a majority of harvest prices have been lower. In contrast, in recent years, harvest prices have increased.

Finalize Your Policy Before March 15th

Now is the time to finalize your crop insurance. The deadline is March 15th, 2023.

It is vital to have the right partner to guide you in creating a plan. Precision Risk Management provides our customers with a full crop insurance risk management strategy tailored specifically for their operation. Every operation has different needs and requires a different strategy.

If you would like to contact a PRM Risk Management Advisor to see how they can help your operation, you may contact them here