The February base price for corn is $4.58 and $11.87 for soybeans for Revenue Protection (RP) and Yield Protection (YP) crop insurance policies. These commodity prices are significantly higher than last year. With Revenue Protection, it can lead to a high payout if the right combination of factors occurs.

For operators choosing Revenue Protection (RP) as their policy option, this is a very high starting point for prices and brings with it a higher chance for price declines.

The payout or indemnity of Revenue Protection crop insurance policies is determined by two different prices: base price and harvest price. The base price was set in February. The harvest price will be set in the month of October by referencing the November CBOT for soybeans and the December CBOT corn contract. The differences between harvest and base price will determine if and how much a payout will be. If revenue falls below the purchased guarantee level, an indemnity payout is given.

With the high base commodity prices, the revenues guarantee in RP policies are also locked in at high levels. This is great news for operators as they can rely on the strong revenue guarantee as the least amount of money they will generate known as the minimum revenue guarantee.

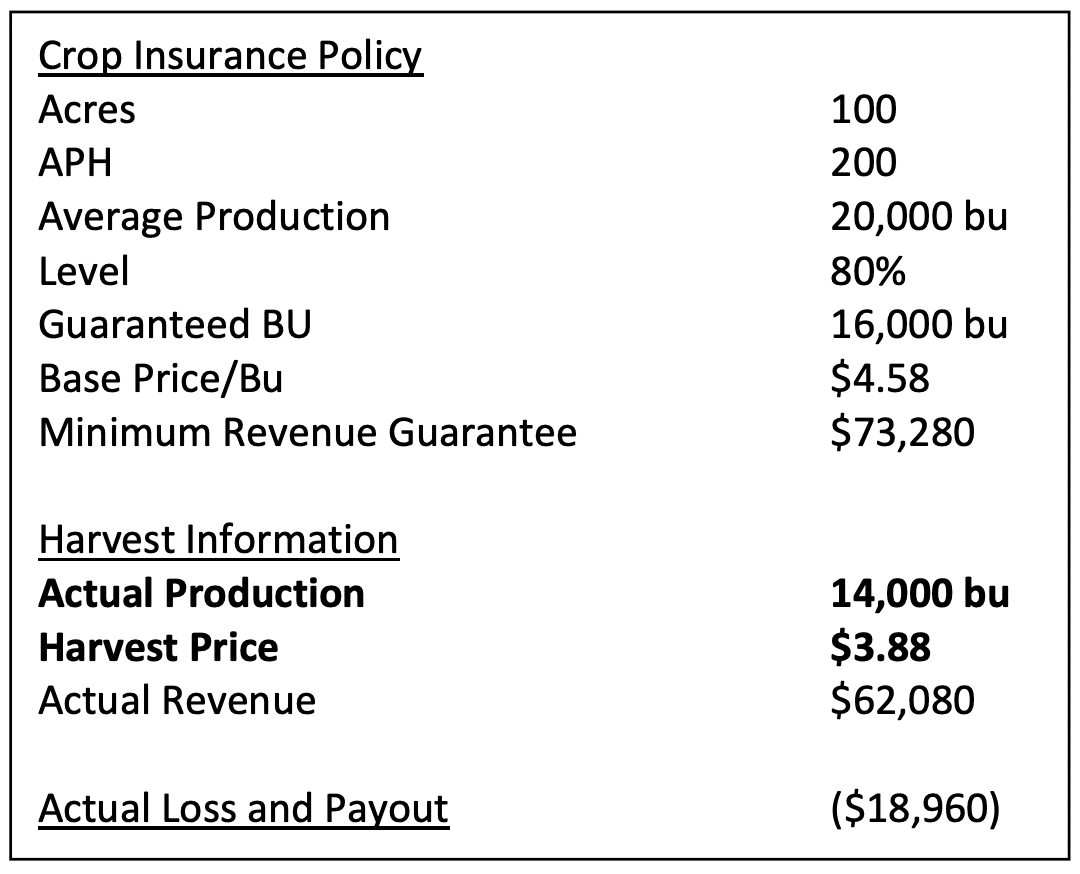

Let’s take a look at how that is possible and what factors could lead to an indemnity payout in a Revenue Protection (RP) policy. To illustrate this, we will examine a 100-acre corn operation.

In this policy, the actual production history (APH) is 200 bushels per acre giving the entire operation an expected 20,000 bushels. The commodity price of corn set at $4.58 creates an expected revenue of $91,600. The purchased 80% coverage level creates 16,000 guaranteed bushels and a minimum revenue guarantee of $73,280. Any combination of factors below will create a loss claim and an indemnity payout.

Drop in Both Harvest Price and Production

A drop in bushels per acre and price can create a large indemnity payout for 2021. If prices fell to $3.88 (around where the base prices were in 2020) with 60 bushels below APH, the payout would be $18,960 to the operator.

Minimum Drop in Harvest Price

In this scenario, only the harvest price has fallen. It would require prices to drop to $3.66 to create an indemnity payout. Anything above $3.66 and the revenue would still be above the guarantee.

Minimum Drop in Production

If commodity prices stay exactly the same, it requires a large drop in production down to 160 bushels per acre. This level exactly covers the revenue guarantee. Any production at or below 159.9 will cause a payout.

Increase in Harvest Price with Drop in Production

Even with a harvest price increase, it is still possible to have a payout if the production drops enough. Droughts have caused this type of scenario in previous years. In this case, the price increases to $6.00 per bushel but the production was cut to only 100 bushels per acre. It results in a large payout of $36,000.

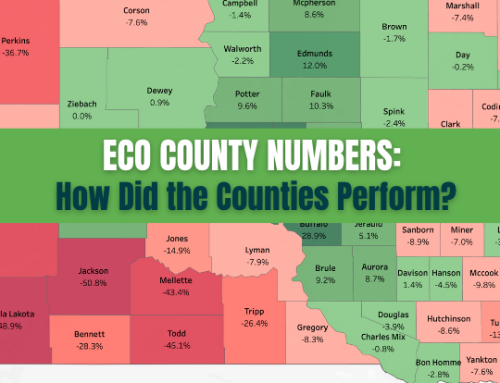

The number of combinations to create a payout for a RP policy is too vast to list all of them in this one explanation. PRM is able to provide its insured with this graph to showcase all the scenarios where a payout would occur.

The starting point is $4.58 price and 200 bushels per acre. It can be seen what factors need to change to trigger an indemnity payout per acre highlighted in green.

What This All Means

Some experts are predicting a drought for the 2021 planting season for states such as North Dakota and South Dakota but not for other Midwest states. A drought could have an unequal effect on yields across the country. If the harvest price also drops, large indemnity payouts are possible for parts of the country.

The higher the base commodity prices the larger the minimum revenue guarantees. It comes with its own drawback of higher premiums than last year. A balancing act is needed to find the correct solution for each operation.

There are many things a grower needs to be watching in order to see how it will affect their policy and if an indemnity payout will be received. A trusted PRM Risk Management Advisor can take the lead and burden from the grower. The Advisor can educate and help the grower decide the correct coverage for their operation. There is no one size fits all policy as each operation is unique.

Not all coverage or products may be available in all jurisdictions. The description of coverage in this document is for informational purposes only. Actual coverage will vary based on the terms and conditions of the policy issued. The information described herein does not amend, or otherwise affect, the terms and conditions of any insurance policy issued by Church Mutual S.I. Insurance Company.