|

|---|

By Samantha Ayoub, Economist, American Farm Bureau Federation

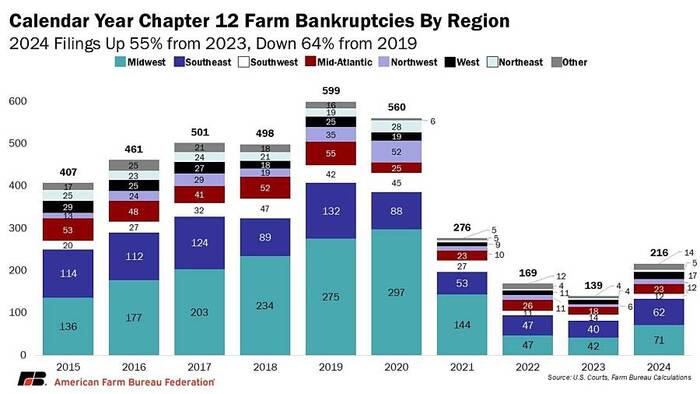

An indicator of farm financial health across the country, Chapter 12 bankruptcy provides farmers and ranchers with increased flexibility for paying off debt, and is used when all other options have been exhausted. AFBF Market Intel reports have long followed annual filings of Chapter 12 farm bankruptcies, through good and bad years for the farm economy.

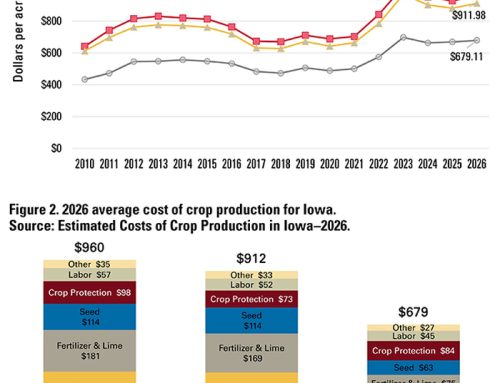

Unfortunately, as we look ahead to another year of declining farm receipts, particularly in crop markets, we can look back to 2024 and see the impacts of that drop in income in the increase in the number of farms filing for bankruptcy.

The U.S. Courts reports that 216 farm bankruptcies were filed in 2024, up 55% from 2023. This is still 64% lower than the all-time high of 599 filings in 2019. However, 2024 is the end of a four-year downward trend in bankruptcies, which appears to mark a turning point in long-term farm financial health.

Farm Bankruptcies by Region

All but one region had increases in Chapter 12 bankruptcy filings last year. Bankruptcy filings in territories and states outside the contiguous 48 states – designated “Other” by the U.S. Courts – more than tripled in 2024, hitting a five-year high of 14 bankruptcies. However, this is still lower than any year between 2007 and 2019.

To read the entire report click here.