PRF County Averages: A Long-Term Look at Protection for Grazing and Haying Acres

Ranchers face a simple but serious challenge: you can do everything right in your operation, but you can’t control precipitation. That’s where Pasture, Rangeland, and Forage (PRF) insurance steps in as a powerful risk management tool.

As a Risk Management Agency (RMA) program, PRF is designed to help ranchers offset losses caused by below-normal rainfall. While some years may not trigger a payment, the long-term performance of PRF data shows why it’s an important risk management tool for producers. PRM has organized PRF data by county to show the performance in your area. You can view your county’s data here:

Understanding PRF: A County-Based Rainfall Index

Unlike other crop insurance based on yield or revenue, PRF is based on precipitation. It uses a Rainfall Index to measure precipitation levels within a defined grid in your county. When rainfall during your selected coverage period falls below historical averages, an indemnity payment is owed to the rancher.

Each policy is tied to specific grids, not individual operations. That means even if your ranch experiences good grass growth, you could still qualify for a loss payment if your grid comes up short on rainfall. Over time, it has proven effective for producers who are insuring haying and grazing acres.

Explore the Data: PRF County Averages Tool

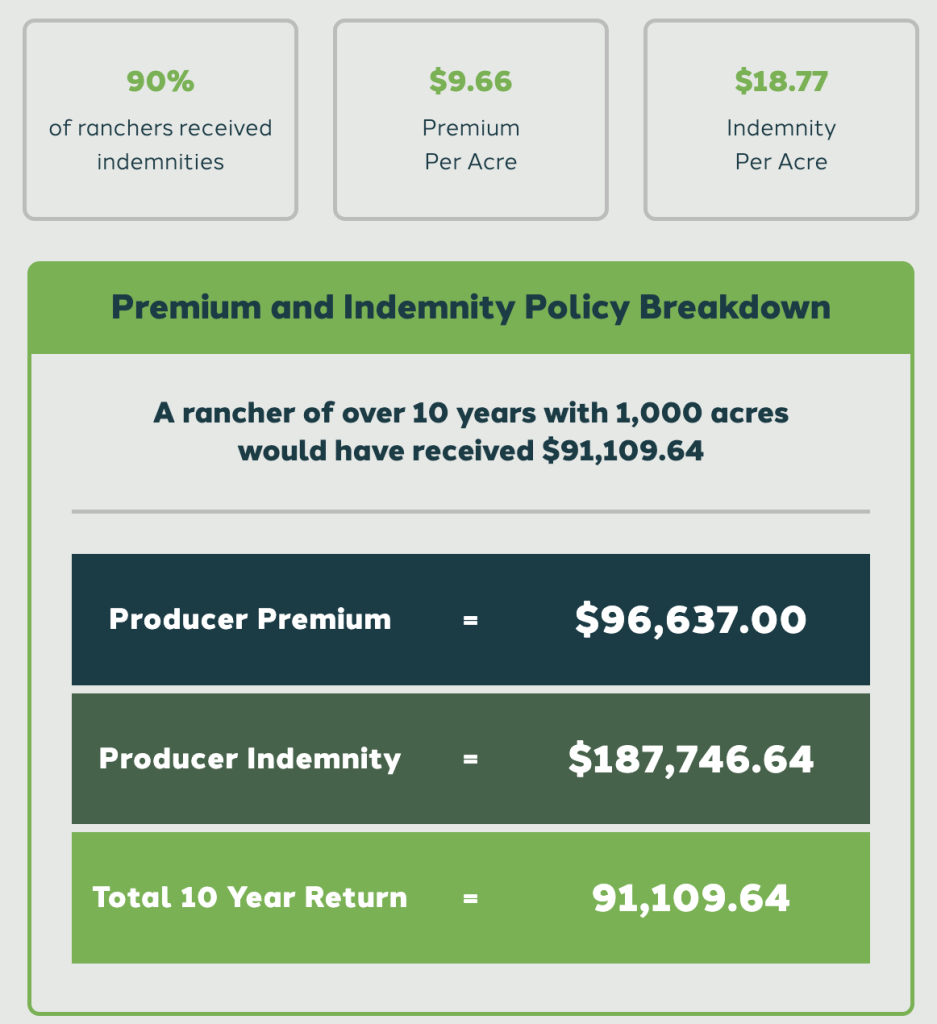

Precision Risk Management (PRM) offers an easy-to-use online tool that allows you to review 10-year PRF performance data by county. This resource shows the average producer premium paid, average indemnity received, and what percentage of policies in the county received an indemnity payment.

You can view your county’s data here:

County Spotlight: Hamlin, South Dakota

Hamlin County offers a clear example of PRF’s long-term value.

You can view your county’s data here:

PRF Works Over Time

PRF is not designed to guarantee a payment every year. It is built as a long-term risk management tool. Just like any insurance product, its strength is in protection against the unexpected.

In years when rainfall is above average, you may not see a payout. But when your grid experiences dry conditions, PRF steps in. And when you look at the 10-year average across many counties, the trend is clear: PRF provides consistent protection and cost-offsets.

Your Policy Personalized and Optimized

The averages speak for themselves, but your ranch deserves more than just average. With PRM’s PRF optimization tools, we can help tailor coverage to your interval selections and risk tolerance. Don’t leave your haying or grazing acres exposed. Connect with a PRM Risk Management Advisor today and see how PRF could strengthen your bottom line.