With large commodity market swings, several weeks are very important for farmers who want to protect the top-end of their revenue. The Price Discovery Period is happening now for Margin Protection (MP) and the Margin Coverage Option (MCO). This period sets the prices that drive your guarantee and your premium. If you want to lock-in coverage levels up to 95%, this is the time to pay attention.

First Week of Price Discovery

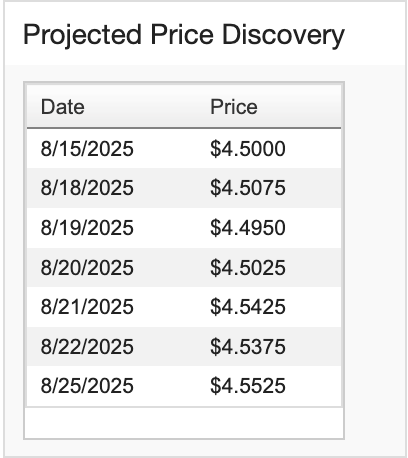

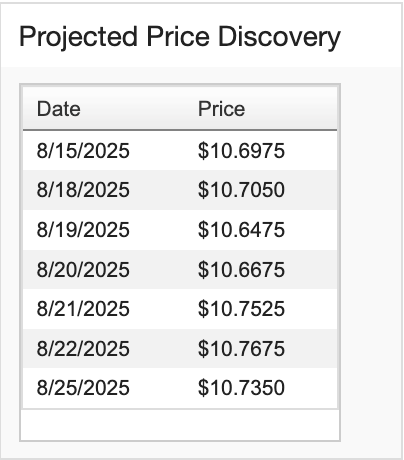

There have only been 6 days of settled pricing in the Price Discovery. This is the starting point for the 30-averages:

Corn $4.52 | Soybeans $10.71

What the Price Discovery Period is

The Price Discovery Period is a set window when the program takes the market price from each day of trading, then averages those daily prices to set the official commodity price for the insurance coverage.

- For MP and MCO, the window runs Aug 15 through Sept 14.

- Each trading day in that window adds one daily price to the running total.

- At the end, all daily prices are averaged.

- That average becomes the base price used for each crop in each eligible county. It helps set your coverage and your premium.

Think of it as the “starting price” or a “floor price” that MP and MCO will use for your crop this year. This is locking in the floor of the pricing for the policies. The pricing will never go lower than this price but can go higher during harvest.

A Simple Example

If corn’s daily prices over the 30 days average $5.20/bu, then $5.20 is the base commodity price MP and MCO use.

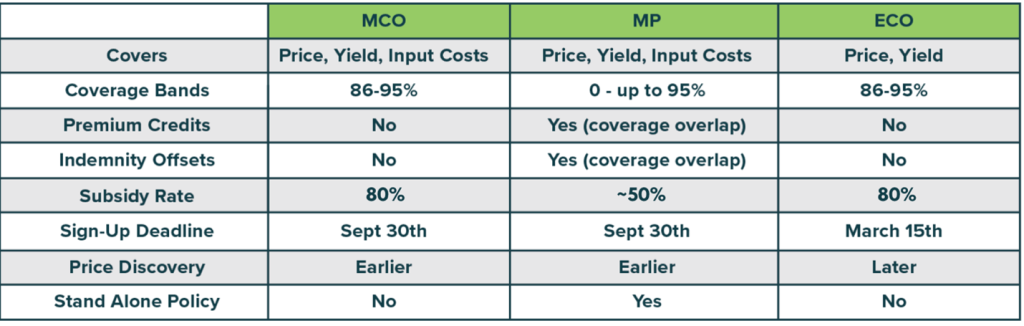

MP And MCO vs ECO: Timing Is the Difference

Enhanced Coverage Option (ECO) uses the same idea of a price discovery window, but on later dates. ECO uses Feb 1 to Feb 28. Margin Protection and the Margin Coverage Option use Aug 15 to Sept 14. These coverages are very similar with one of the key differences being the pricing periods.

How the Base Price is Used During Harvest

During harvest there is a second window that produces a harvest price. Each product then compares the base price and the harvest price, along with its own county results and other program factors, to determine whether an indemnity is owed. The math is different for each product, but that comparison of base to harvest is always part of the story. That is the one of the main reasons why farmers want to lock in the “floor price” of the Price Discovery Period.

Why this Matters Now

Many growers want to lock in a strong price in the fall with MP or MCO when markets are strong. If the market is lower by the time the harvest price is set, that early base can help. ECO uses a later base in February, which lets you elect coverage off late winter conditions instead. Timing is the difference.

What this means for your strategy

- MP and MCO lock earlier, which can be useful if you want to lock in coverage against fall market and input shifts.

- ECO locks later, which can be useful if you prefer your coverage to be determined by the winter into spring market.

- Many growers like evaluating the early pricing period for MP or MCO. Then keep ECO as a later option if they don’t like where the prices were set for MP and MCO.

- Your Risk Management Advisor will work with you on which is the best product for your operation based on your risk profile and availability for your county and crop.

One way to evaluate the potential to lock-in a higher price in the spring is to compare it to where the future markets are trading. Below are the prices for where the Projected Base Price is and what the prices are for the future’s market for each crop. The Price Discovery Base Price is currently trading higher than the future’s market price. Prices will change before the second Discovery Period but this is one data point to consider.

| Projected Base Price* | Future Market Prices* | |

| Corn | $4.52 | $4.12 (Dec 26) |

| Soybeans | $10.71 | $10.48 (Nov 26) |

*Prices as of Aug 26th, 2025

Get To know your Top End Protection Products

All three of these products are very similar in coverages and names. It is important to know the differences to find the best coverage for your operation and goals.

At first glance, these products might look nearly identical. They all offer coverage above 80% levels, aim to protect revenue and margin, and are often used in tandem with your underlying Revenue Protection (RP) policy. But the nuances on how each one works, when they’re triggered, and how they pair with your operation’s risk profile can make all the difference in your bottom line.

Want to go in-depth on each product? Click the links below

Disclaimer: This is for educational information only. This is not a recommendation of coverage, legal, or financial advice. Speak to a licensed Risk Management Advisor for any policy recommendations.