Each season brings its own unique challenges and uncertainty to it. The stability of commodity prices and the potential for a significant drop are top of mind for 2024. For growers, understanding the nuances of their fields— identifying which parts bring the highest yields and which cause unprofitable acres—has never been more crucial.

An updated Profitability Analysis Case Study conducted by Precision Risk Management (PRM) showcases the importance of growers’ understanding how the slipping prices affect their operation’s profitability acre by acre. We examine a single field’s profitability changes from last year’s harvest to where they could end up this fall.

Precision Data: The Key to Deeper Knowledge

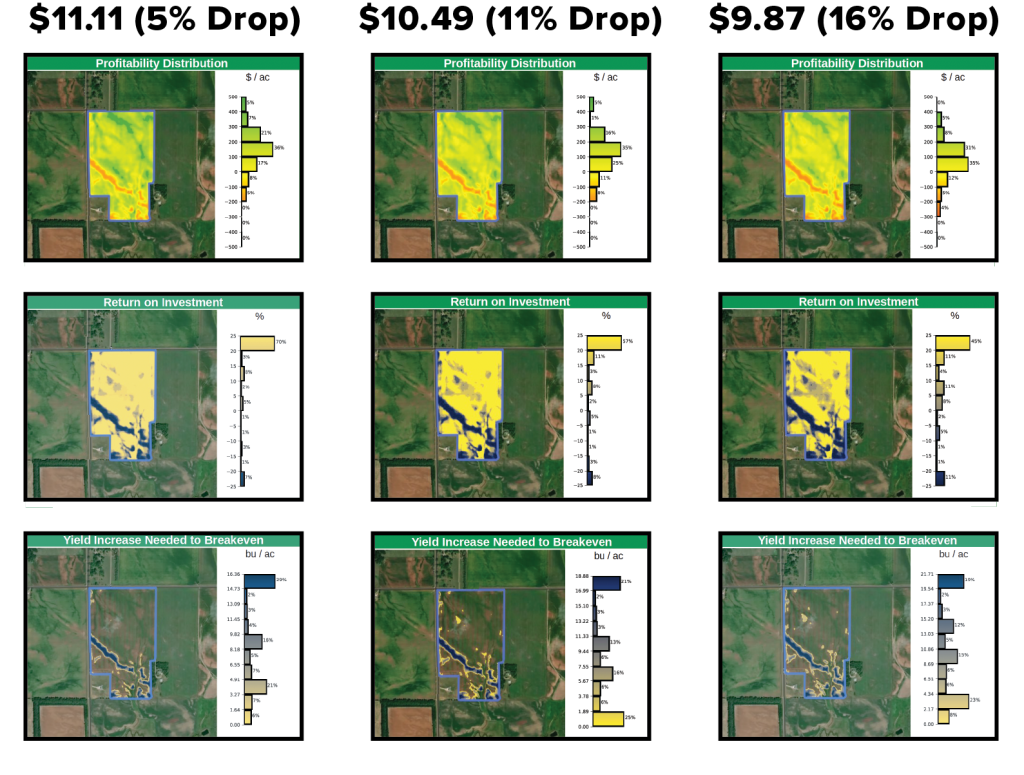

In an era where commodity prices are on a downward trend, the margin for error narrows significantly. The stark reality is that with every cent that prices dip, a larger portion of the field teeters on the brink of unprofitability. This precarious balance makes it imperative for growers to possess an intimate understanding of their land. Knowing the exact location of unproductive and unprofitable areas within their fields is not just beneficial—it’s essential for success.

The significance of pinpointing these critical areas cannot be overstated using precision data. In times of buoyant market prices, the cushion of high returns may mask the underperformance of certain field segments. However, as prices drop, the truth is revealed: there is no room for inefficiency or wasted input costs. It’s in this context that the breakeven points for every inch of the field become vital pieces of information. The precision data with analysis informs strategic decisions about where to invest resources and where to cut losses.

The 2023 Harvest: A Record Year For Many

This analysis will look at a single field in South Dakota. The analysis compares soybean prices in 2023 and 2024, with crop rotations not considered to compare apples to apples.

The analysis begins with a retrospective look at the harvest of 2023, where soybean prices stood at a robust $12.84 per bushel. This price point offered growers a relatively comfortable margin of profitability, with returns reflecting the benefits of strategic farming and market positioning.

This high soybean price translated to a Return on Investment (ROI) of 52%, showcasing a robust profit margin of $246.6 per acre and a total profit of $21,241. These numbers highlight a season of prosperity. You can see in the Profitability Distribution map under 8% of the field is a negative return.

Today’s Reality: Adjusting to the New Base Price

Fast forward to today, the landscape has shifted with the projected base price for soybeans adjusting to $11.73 per bushel. This adjustment has seen a decrease in ROI to 39%, a clear indicator of the immediate impact of market fluctuations on farm income. The total profit has tapered to $15,884, with profit per acre dropping to $184. The change underscores the necessity for growers to remain vigilant and adaptive to market trends.

In the Profitability Distribution, you can see more of the field going negative, now at 13%. The Yield Increase and the Expense Reduction Needed to Breakeven are both also increasing.

Projecting a Possible Future: The Cost of Decline

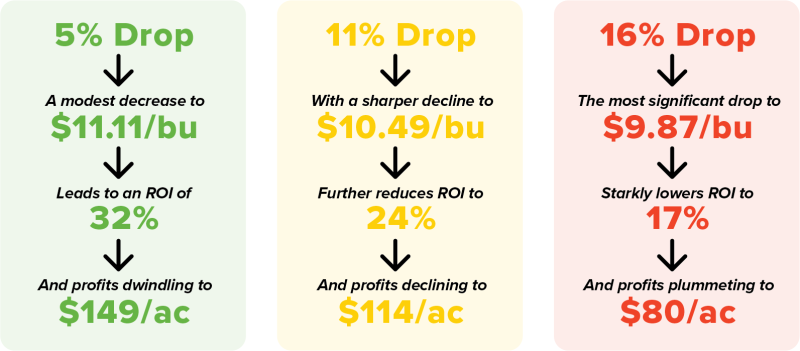

To further illustrate the critical nature of this analysis, PRM explores hypothetical scenarios where soybean prices continue their descent, dropping by 5%, 11%, and 16%. These projections paint a vivid picture of the future, one where profitability is increasingly difficult and more portions of the field are causing a negative return on farm income.

The PRM Advantage: Charting a Course Through Uncertainty

In the face of these pricing challenges, Precision Risk Management (PRM) is a vital ally for growers wanting to manage their increasing risk. Through meticulous risk analysis and tailored profitability assessments, PRM equips farmers with the insights and coverage needed to navigate the market volatility.

By identifying precise breakeven points and underperforming field segments, growers can make informed decisions that optimize profitability and success. Growers begin the year with fluctuating commodity prices, highlighting precision data and strategic planning. As growers face the dual challenges of market volatility and declining prices, the insights provided by PRM’s profitability analysis become invaluable. By embracing these tools and strategies, farmers can secure their operations’ future.