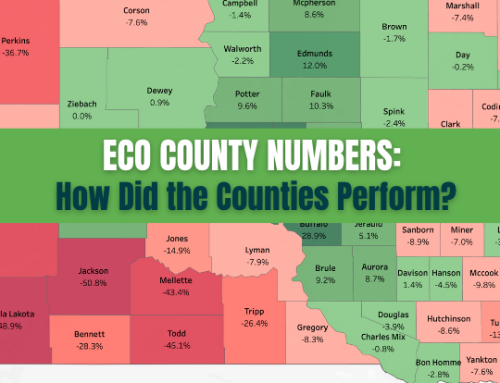

Top producers can’t afford inaccurate crop insurance. Utilizing the traditional ways of reporting crop insurance may be causing growers to be overpaying on premiums and reduce overall profitability. Precision Risk Management does crop insurance differently than any other provider.

Traditional FSA/CLU maps can overestimate your premium and provide coverage to areas where there are no crops. Using precision technology and a full support team, PRM ensures you only pay for the for the insurance coverage you need.

Up to 7% Operation Crop Insurance Savings.

A producer can be paying for crop insurance where there are no crops.

There is no requirement to insure every FSA acre and, very likely, every acre shouldn’t be insured. Only the acres that were planted that season should be insured. Otherwise, the grower is creating unnecessary insurance coverage and added premium.

In one field example, there is a 10.9% difference between what FSA acres recommend insuring and Precision Planted acres. That is a $166.04 savings in crop insurance premium. It is not immediately clear the large impact of the difference until you examine the effect on an entire operation. With an average of 7% difference, a 4,000- acre operation will save $19,852 over 5 years.

Increase Your APH with Precision Planted Acres

Using FSA acres can artificially lower a grower’s actual production history (APH). Total production for a field is divided by the number of planted acres to calculate the APH. When the acres are overstated using FSA instead of the true planted acres, it drops the APH. This lowers the maximum potential payout for any claims.

A 21.27 bushel difference of corn in our 7% operation example increases a crop insurance guarantee of $145.91 per acre. Across 4,000 acres, that is a $583,648 increase in guarantees. Using Precision Planted acres have a lasting impact on your operation through your APH.

Why is there a difference?

There are many reasons why FSA acres and Precision Planted acres may not match. FSA acres are records indicating the entire possible amount of land that is theoretically possible for planting. Many times, a producer can’t or does not want to devote inputs to certain areas of a field. Precision Planted acres using precision technology during the planting process only account for the acres where seed was put in the ground.

Precision Risk Management’s precision technology set-up process is only intended for use with crop insurance data collection and reporting. Other applications of the precision technology are possible but are not provided by PRM. Actual premium reduction amounts will vary by grower. Not all coverage or products may be available in all jurisdictions. The description of coverage in this document is for informational purposes only. Actual coverage will vary based on the terms and conditions of the policy issued. The information described herein does not amend, or otherwise affect, the terms and conditions of any insurance policy issued by Church Mutual S.I. Insurance Company. PRM is an equal opportunity provider.