Key Takeaways

– The Discovery Period will set the initial crop price for crop insurance policies

– This price is determined by averaging future contracts in Feb

– Base price will determine many parts of crop insurance policies such as guarantees per acre

– A second discovery period will happen during harvest

– Higher of the two prices will be used in some policies

The Price Discovery Period is very important for producers to pay attention to while planning for the new crop season. This process will set the initial price of a bushel for their crop insurance policies.

The Risk Management Agency (RMA) uses market prices from the Chicago Board of Trade (CBOT) to calculate the projected prices. Specifically, they take the daily closing prices of futures contracts and average them out to create a projected price for crop insurance. This allows them to identify trends in the market and ensure producers receive a fair price for their crops in case of a loss situation.

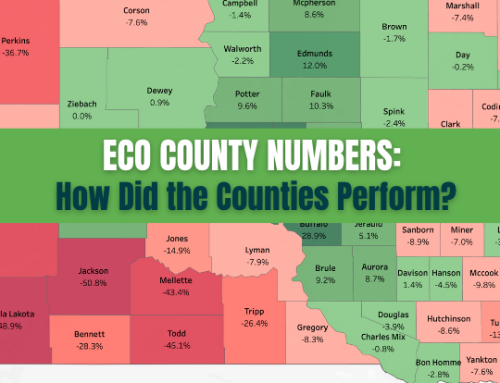

The projected price discovery period can be different for each crop and state. For corn in most states, the discovery period is February 1st through February 28th using December contracts. For soybeans, the discovery period is also from February 1st through February 28th using November contracts for most states.

The projected price discovery period is an important part of crop insurance because it helps producers see a baseline for their crop insurance such as total guarantees.

The Projected Price x APH x Coverage Level =Guarantee

$6.00 x 175 APH x .8 Coverage Level = $840/acre

$7.00 x 175 APH x .8 Coverage Level = 990/acre

This period allows producers to plan with their Risk Management Advisor and make sure they have enough coverage for their crops to meet their operation’s revenue goals and risk tolerances. It’s also helpful for those who need to buy additional coverage or switch to another policy type if needed.

In addition to setting a projected price for each crop, the Price Discovery Period also calculates the volatility factor. The higher volatility usually translates to higher crop insurance premium rates. This volatility factor is trying to capture how uncertain the overall markets are about what prices will be during harvest. The more uncertainty the higher the premium costs. The volatility factor is determined by averaging the last 5 days of the discovery period.

The projected price set in February is only the first of two discovery periods for some policies. A Harvest Price Discovery Period will set a second price using the same CBOT process of averages. Most states Harvest Price Discovery Periods for corn and soybeans are in October. Crop insurance policies using projected prices will take the higher of two to determine guarantees and other policy information.

What these prices are set at has a large impact and has different implications for each operation. A Risk Management Advisor can help consult and adjust your policies based on single-year and long-term planning.