by Bradley Zwilling, Illinois FBFM Association and Department of Agricultural and Consumer Economics, University of Illinois

Based on Illinois Farm Business Farm Management Association (FBFM) records, average farm operator returns for labor and management on 2,009 Illinois farms were lower for all geographic areas in the state in 2024 compared to 2023 and below the average for the last five years. Even with higher yields and lower costs, lower grain prices were the main reasons for the lower incomes. Livestock farmers experienced higher returns due to lower feed prices and higher prices for livestock and livestock products.

Farm earnings were highest in the central and western areas of the state. Earnings were lowest in the northeastern and southern parts of the state.

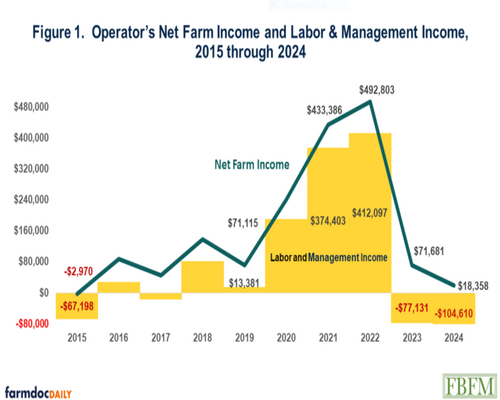

Operator’s Labor and Management Earnings

The average return to the operator’s labor and management income in 2024 was negative $104,610 a sharp decline since 2022 (Figure 1). This figure represents the farmer’s effective wage or salary. This is what remains from the operator’s net farm income after a fair return to the operator’s equity in machinery and land has been subtracted. The 2024 returns were $27,479 below the 2023 average of negative $77,131 and $265,330 below the average for the last five years. Operators’ labor and management income ranged from about negative $276,707 in the most southern part of Illinois to negative $95,486 in the most central part of Illinois. The 2024 earnings are the lowest for any year during the last ten years. Labor and management incomes have varied greatly during the last ten years, ranging from a low of negative $104,610 in 2024 to the high of $412,097 in 2022.

While the 2024 labor and management earnings are at low levels, one needs to remember that farm earnings, like earnings for many other businesses, can be cyclical in nature and have wide swings from year to year. Farm earnings are dependent on several factors outside the farmer’s control, such as weather, markets, and government policy. From that standpoint, it may be helpful to look at farm earnings over a longer period. The 2020 through 2024 five-year average of labor and management earnings was $158,720 while the 2015 through 2024 ten-year average of labor and management earnings was $83,184, $187,794 above the 2024 earnings. If you remove the two highest values on record that occurred in the last ten years (2021 and 2022) from the latest ten-year average, that eight-year average is only $5,668. The 2024 level of earnings is considerably below the last five and ten-year averages.

Crop Yields and Prices

Corn yields were above the relatively good yields recorded the year before. Corn yields were 11 bushels per acre higher in 2024 compared to yields recorded in 2023. Soybean yields were 1 bushel per acre higher than in 2023. The average corn yield on the 2,009 farms was 234 bushels per acre. Soybean yields averaged 69 bushels per acre. Corn yields were the highest in the western and central parts of the state, generally north of the I-74 corridor and west of the I-39 corridor. Soybean yields were generally highest in the central parts of the state. The average corn and soybean yields were the highest on record. The year-end inventory price for the 2024 corn crop of $4.10 per bushel was thirty cents per bushel lower than a year earlier. Soybeans were inventoried at $9.60 per bushel, $3.15 lower than December 31, 2023. The average sales price received for the 2023 corn crop sold in 2024 was sold almost at the inventory price while the 2023 soybean crop sold in 2024 was below the inventory price. Crop returns averaged $872 per tillable acre, $103 per acre lower than the 2023 crop returns. The average crop returns per acre were the second lowest in the last 5 years and $422 below the highest average crop returns in 2022.

Earnings By Farm Type

Operators’ labor and management earnings were highest on dairy farms followed by beef, hog, and grain farms. Returns averaged $167,039 on dairy farms, negative $20,184 on beef farms, negative $132,978 on hog farms and negative $134,744 on grain farms. Farms classified as grain farms were 92 percent of all farms while hog farms comprise one percent of the total. Livestock farms may include returns from grain production as well.

The average size of these farms continues to grow, averaging 1,332 tillable acres in 2024. This was 69 acres larger than five years ago. Farms classified as grain farms averaged 1,390 tillable acres compared to beef farms, which averaged 454 tillable acres.

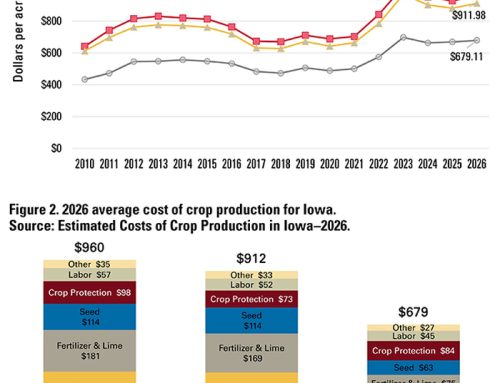

Costs Begin to Decrease

Per acre fertilizer, pesticides and seed costs were lower compared to the year before but much higher than five years earlier. Crop costs on the 2,009 farms averaged $335.48 per acre in 2024 compared to $392.78 in 2023. Fertilizer decreased 26 percent, pesticides decreased 5 percent, and seed decreased one percent. Tillable acres planted to corn decreased by 1.8 percent while acres planted to soybeans increased by 2.0 percent when compared to 2023. Compared to 2020, fertilizer costs have increased 52 percent, pesticides have increased 58 percent, and seed has increased 15 percent. Fuel and oil costs averaged $27.34 in 2024 compared to $30.82 in 2023 and $18.35 in 2020. Most of these costs are expected to stay about the same for 2025 and 2026, except for fertilizer.

Spending on machinery and equipment was lower than the year before. Capital expenditures decreased 30 percent in 2024 compared to 2023, averaging $228,799 per farm, or $172 per tillable acre. Machinery purchases in 2023 averaged $243 per tillable acre while 2022 averaged $212 per tillable acre.

Costs to Grow Corn and Soybeans

Total economic costs per acre to produce corn and soybeans in 2024 decreased as compared to 2023 in all areas of the state. The main factors for the decrease in per acre costs were due to lower fertilizer, fuel and land costs. Cost per bushel to produce corn decreased in all areas of the state due to lower costs and higher yields compared to 2023. The cost per bushel to raise soybeans decreased in all areas of the state besides southern Illinois. Total economic costs per acre to raise corn and soybeans on these farms averaged $1,221 and $903 respectively.

From a sample of pure grain farms in the state, the total economic costs per bushel of corn produced were $5.20 with an average yield of 235 bushels per acre. The total costs per bushel of soybeans were $12.90 with an average yield of 70 bushels per acre. This compared with costs per bushel of $5.82 and $13.46 for corn and soybeans respectively in 2023. Even with the higher yield and lower costs, this was the second highest cost per bushel to grow corn since 2012. The 2024 cost to grow soybeans per bushel was $1.05 higher than the last five-year average and $1.89 higher than the ten-year average. This was the third highest cost per bushel on record for soybeans. The variation in yields and costs over the past few years makes it important to analyze these costs over more than one year. The 2015-2024 ten-year average cost to produce corn and soybeans on these farms is $4.59 per bushel for corn and $11.01 per bushel for soybeans.

Livestock Returns

Returns above feed cost were higher than the year before for all livestock enterprises except beef enterprises. Also, returns above feed costs in 2024 were above the last five-year average. All livestock enterprises experienced lower feed costs in 2024 compared to 2023. Much higher pork prices and lower feed costs were the main factors for the higher hog returns. Returns for farrow-to-finish hog producers were estimated to be about $3 per hundredweight above the breakeven level in covering total economic costs in 2024. Dairy producers had $3,423 returns above feed per cow in 2024 compared to $2,767 in 2023. Milk prices were 9 percent higher while feed costs were 10 percent lower compared to the year before. Returns to feeder cattle enterprises were higher than the year before and the highest in the last five years. Returns were higher due to higher prices received for market cattle and lower feed costs. Prices paid in 2024 for replacement cattle were 17 percent above the year before. Cattle prices received were about $69 per hundredweight lower than prices paid for replacement cattle, but 10 percent higher than the market price received last year. Returns above feed per cow decreased $74 for beef cow enterprises due to very high returns in 2023. 2023 beef cow enterprise returns were the highest of the last five years.

Good Records a Key

The author would like to acknowledge that data used in this study comes from the Illinois Farm Business Farm Management (FBFM) Association. Without Illinois FBFM, information as comprehensive and accurate as this would not be available for educational purposes. FBFM, which consists of 5,000+ farmers and 70 professional field staff, is a not-for-profit organization available to all farm operators in Illinois. FBFM field staff provide on-farm counsel along with recordkeeping, farm financial management, business entity planning and income tax management. For more information, please contact our office located on the campus of the University of Illinois in the Department of Agricultural and Consumer Economics at 217-333-8346 or visit the FBFM website at www.fbfm.org.