Source: National Crop Insurance Services news release

Overland Park, KS — It could be argued that every civilization in the history of mankind has invested in its food production in some way – from ancient Egypt’s irrigation projects to Roman laws designed to put productive land into the hands of farmers.

And it’s safe to assume that every civilization from this day forward will invest in its food production, too, because of agriculture’s societal importance.

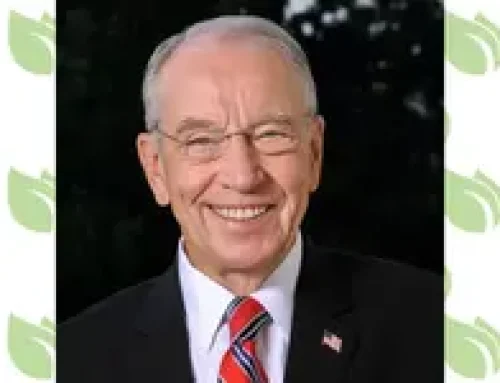

That said, modern-day U.S. farm policy is unique. It just might be the only example out there of farmers taking an active role in funding their own safety net. This feature of crop insurance is the topic of the latest episode of Keep America Growing, a podcast all about crop insurance, hosted by Tom Zacharias, President of the National Crop Insurance Services.

“The system we have in the U.S. is clearly working,” he explained. “Through the marketplace, farmers are voting for the safety net they want with dollars from their own pockets. And they are increasingly spending additional dollars to purchase additional crop insurance protection.”

The numbers tell the story: since the 2018 Farm Bill took effect, U.S. farmers have collectively paid more than $26 billion in crop insurance premiums. In 2023 alone, that number reached $6.8 billion – up from $3.8 billion in 2019.

“That’s a serious investment by the men and women who work to feed and clothe all of us,” Zacharias added. And it’s on top of the deductibles that farmers are already shouldering, or about 25 percent of any loss before insurance kicks in.