Harvest Prices Are Down

The Harvest Prices for Corn and Soybeans

These Fall Harvest Prices will determine if many farmers have a loss and are due a claims payment. Any producers with a Revenue Protection (RP) crop insurance plan should pay close attention to these main points:

- A farmer may have a loss if your revenue is below your insurance guarantee

- If you have already had a claim paid by PRM, you will receive an additional loss payment

- Immediate production reporting is key for revenue loss claims

- Precision Data- use or notify the Data Specialist Team

- Get your questions answered on guarantees or claims by SST or your Advisor

Losses Caused by Revenue Below Insurance Guarantee

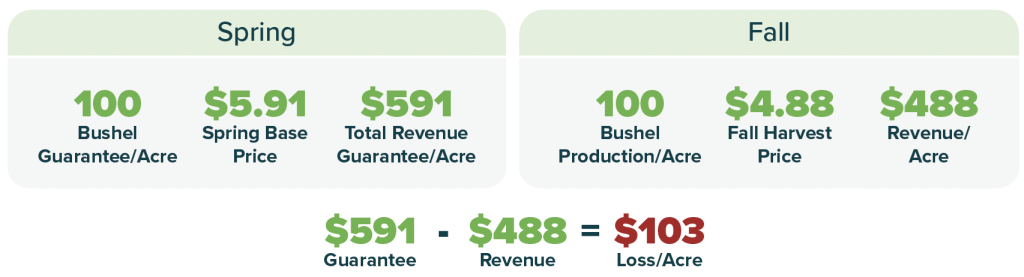

Revenue Protection insurance for crops guarantees a revenue level taking the best of two prices: the Spring Base Price and the Fall Harvest Price. If the Harvest Price falls below the base, the policy pays the difference to the farmer, ensuring income stability.

Since the Harvest Price this year is significantly lower than the Base Price, it is likely a producer may have a loss and is owed a loss payment.

Here is a simple corn example for a small operation:

Revenue Losses Over Bushel Guarantee

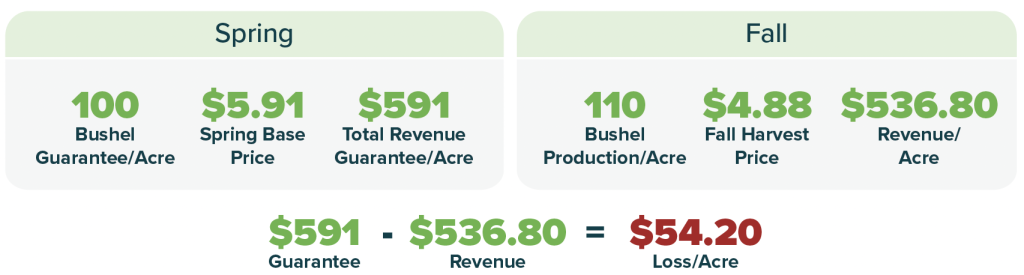

If a producer has a great year and has a productive yield over the bushel guarantee, there could still be a loss with a Revenue Protection policy. The total revenue guarantee is the key factor that needs to be examined.

A bushel guarantee is calculated by taking an average of previous year’s yields. Some additional calculations such as trend adjustments and excluding the lowest yields are used before averaging the remaining yields. This average yield is expressed in bushels per acre and represents the expected yield for the insured crop.

Now, let’s use that in a second simple corn example on the same operation:

Additional Loss Payments Are Automatic

Some producers have already had a loss situation, such as cutting silage, and received a loss check. This payment was based on the Spring Base Price. With the Fall Harvest Price lower, the producer will receive an additional check. There is nothing the customer needs to do. PRM will automatically send the additional payment.

Immediate Production Reporting for Revenue Loss Claims

For Revenue Protection policies, a final production report is needed before the claims process can start. PRM recommends providing your production reports as soon as harvest is completed. You’ll experience faster claim payments, precisely when you need them most. You will also receive all these other benefits from same-year production reporting.

Precision Data- Use or Notify the Data Specialist Team

Precision data makes your production reporting and claims process even easier. PRM’s Data Specialist Team is ready to take the burden of collecting and applying the data from you. When you are done harvesting, notify your Data Specialist so they can collect your data and get reporting completed.

Get Your Questions Answered by SST

Crop insurance gets more complicated the deeper you go, and questions are bound to come up. Your Sales Support Team (SST) and your Risk Management Advisor are here to help. They can go over your guarantees and answer any questions on possible claims. You can contact your Advisor directly or call SST.