Margin Coverage Option: MCO

One of the Easiest Ways to Protect Your Margin

New for Crop Year 2026 and 80% Subsidized

What It Is

Margin Coverage Option (MCO) is a new area-based insurance that protects the profit margin on your crop, not just yield or revenue. It helps cover losses when production costs rise, commodity prices fall, county-level yields drop, or when all three happen at once.

Area-Based Plan

The area-based plan looks at the average yield or revenue for the county rather than the individual far. If the county yield or revenue for that area falls below the averages, MCO provides a loss claim to all insured farmers within that county, regardless of their individual farm’s performance.

Coverage Bands

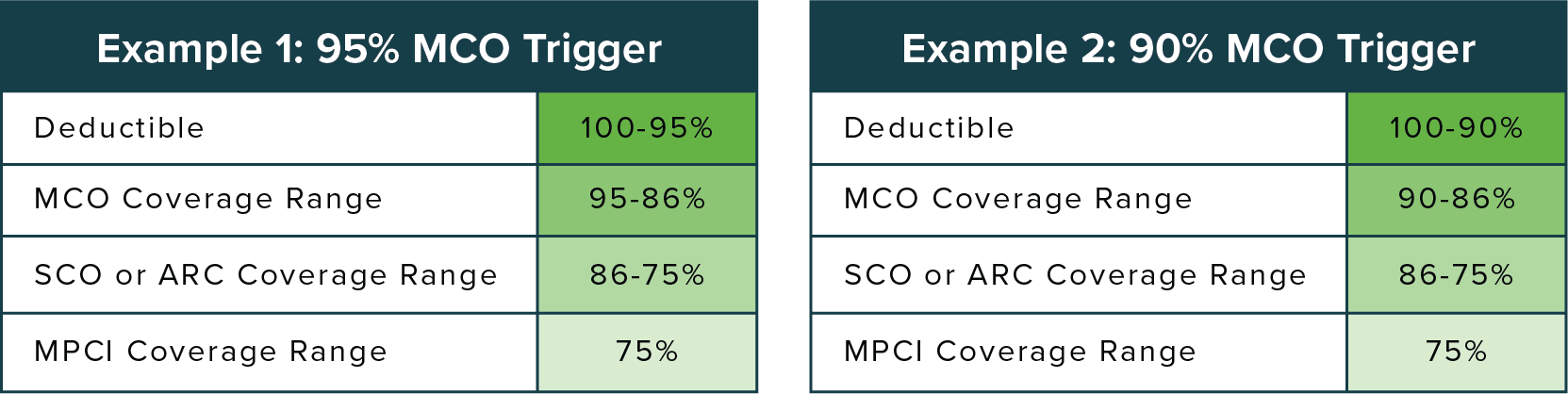

Crop Insurance can be thought of in tiers. The base tier is the Multiple Peril Crop Insurance (MPCI). This tier has the choice of coverages such as Revenue Protection and Yield Protection. The next tier will cover up where the MPCI coverage ends up to 86% of losses.

Margin Coverage Option covers 86% to either 90% or 95% of county revenue, depending on which level of coverage the grower selects.

Watch How MCO Protects Your Margins

Up to 95% Levels

Provides the highest level of insurance in the federal program 90/95%

Area-Based Coverage

Coverage is based on the county averages and production not on the individual operation

Easy CoVerage

Simplified choices for top-layer protection

Early Pricing Period

Lock in commodity prices before your MP policy

Protects Against Lower Prices

MCO covers a drop in commodity prices

Protects against lower County yields

MCO covers a drop in county yields

ProTects AgAinst Rising Input Costs

MCO covers multiple inputs critical for farming

Early Signup deadline

9/30 deadline to sign up for next crop year

Get a Personalized MCO Quote Today

What Does MCO Cover?

1. Rising Input Costs

Urea

Potash

Diesel

Diammonium Phosphate (DAP)

Irrigation Costs

2. County-Level Yield Loss

As an area-based plan, the county yields are the key factor. You could have a great year while your neighbors experience a tough year. You could be owed an indemnity payment for the area based plan while not experiencing a personal operational loss.

3. Falling Market Prices

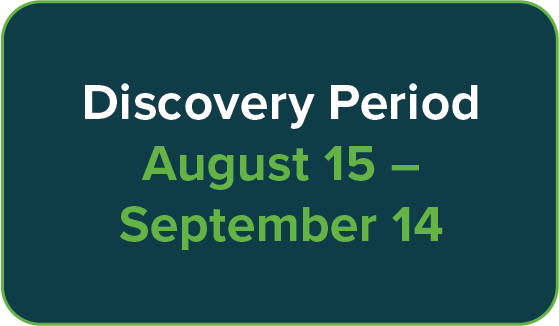

MCO has an earlier Price Discovery Period than the underlying multi-peril crop insurance policy. The sign-up price will be compared to the harvest price. This is a potential opportunity to capture a higher price than the 3/15 price of the underlying multi-peril policy.

4. Combination of All

All of these factors are dependent on each other. Yields and prices can lower while input costs increase. This type of scenario would lead to a large indemnity payment situation.

Margin Coverage, Made Simple.

How Does MCO Work?

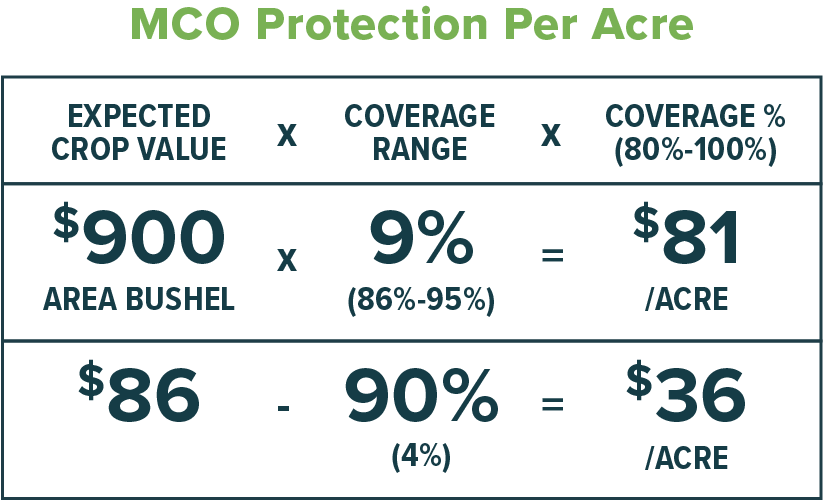

MCO tracks your expected vs. actual margin at the county level (area-based plan). If the actual harvest margin drops below your trigger level, you get a loss payment.

If the Harvest Margin is less than the Trigger Margin (90 or 95% of Expected Margin), an indemnity is triggered.

MCO In Practice

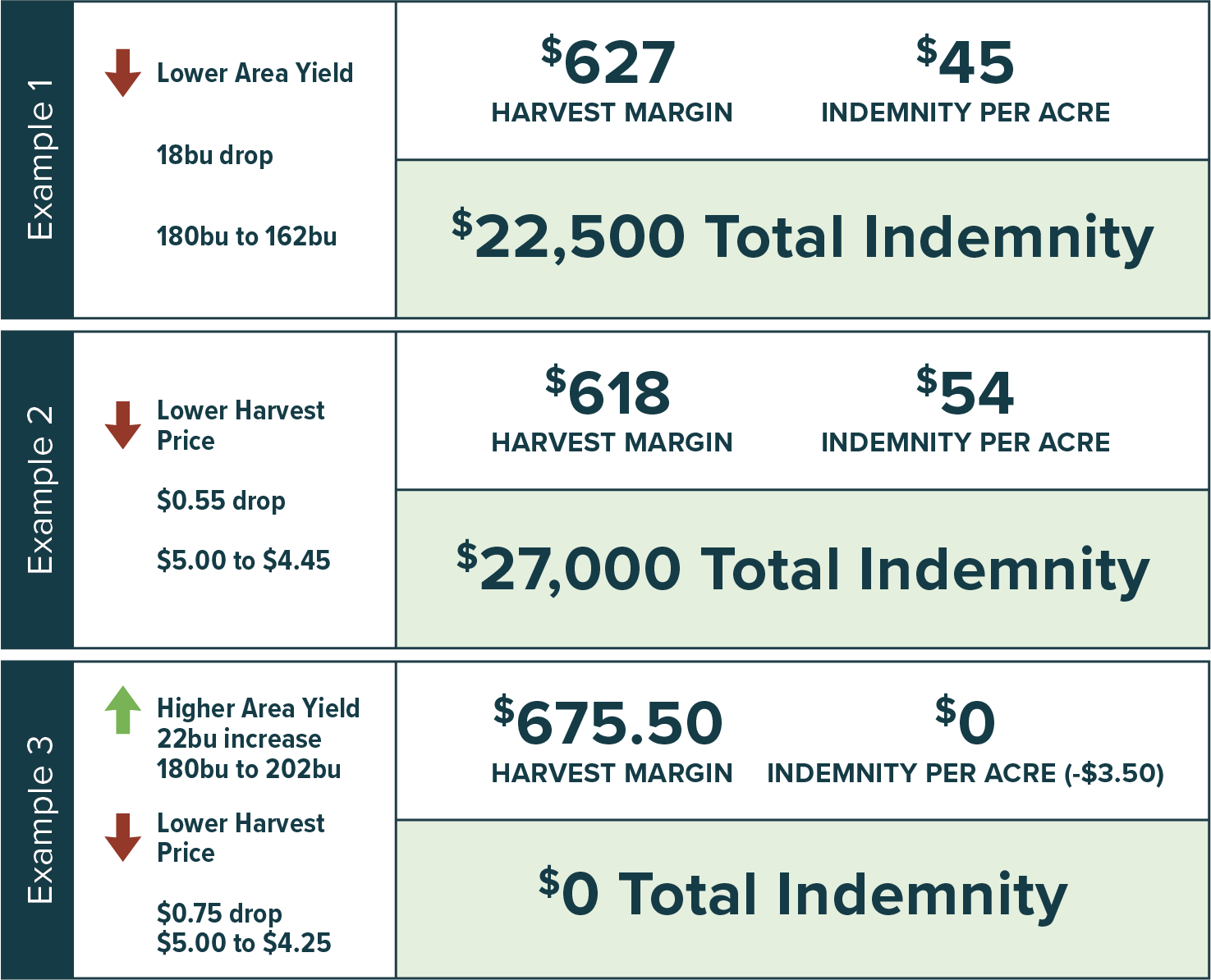

MCO Protects your margins. Let’s look at some examples of how changing variables will affect your MCO coverage and indemnity owed.

We first start with the protection at policy sign-up. These figures are how you determine your trigger margin.

Harvest Margin and Indemnity Owed Scenarios.

Now we take a look at how different input prices, commodity prices, and county yields will determine the indemnities owed.

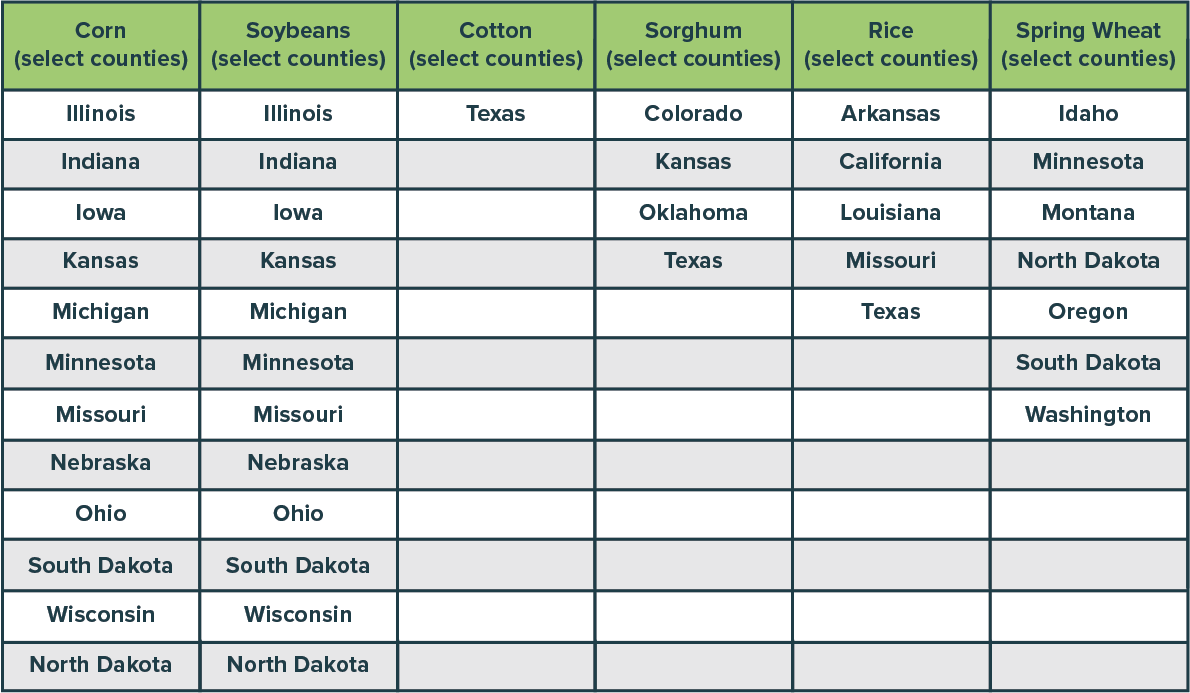

MCO Availability

MCO is compared to lite Margin Protection

It gives you the core margin protection without the complexity or policy overlap. It’s ideal for producers who like the ECO/SCO model but want input cost protection added in. Plus MCO is 80% subsidized.

Pairing MCO

MCO can be paired with:

- ARC

- PLC

- SCO (no overlapping coverage)

- STAX (no overlapping coverage at 90%)

County Specific Analysis

and Personalized Quote

PRM takes a deeper dive into MCO more than any other company. With PRM’s MCO analysis tools, PRM will do a county specific analysis to examine what opportunities there are for a farmer in the area. Using historical yield tracking, the analysis will show where yields are too high or too low compared to expected results.

Personalized Program

Comparison Analysis

Precision Risk Management takes the comprehensive look at your risk management plan to identify the best USDA and FSA programs. PRM will look at your specific operation and county to identify the largest revenue protection and the trigger points for each of the different programs.

Get a Personalized MCO Quote Today

It’s easy to get Margin Protection (MP), Enhanced Coverage Option (ECO), and Enhanced Margin Coverage Option (MCO) confused.

At first glance, these products might look nearly identical. They all offer coverage above 80% levels, aim to protect revenue and margin, and are often used in tandem with your underlying Revenue Protection (RP) policy. But the differences on how each one works, when they’re triggered, and how they pair with your operation’s risk profile can make all the difference in your bottom line.