by James Mintert and Michael Langemeier, Purdue Center for Commercial Agriculture, Purdue University

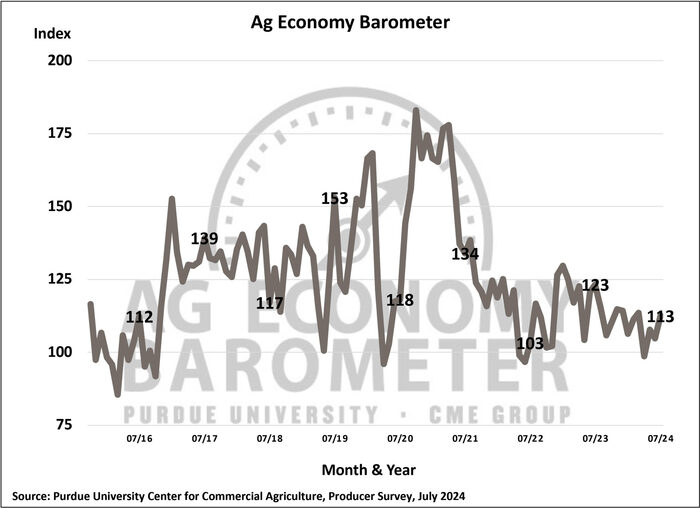

All three broad-based measures of farmer sentiment improved in July. The Purdue University-CME Group Ag Economy Barometer Index rose 8 points to 113. At the same time, the Index of Current Conditions increased by 10 points to 100, and the Index of Future Expectations at 119 was 7 points higher than a month earlier.

July’s sentiment improvement occurred even though prices for both corn and soybeans declined from the time survey responses were collected in June to July. For example, Eastern Corn Belt cash prices for corn and soybeans declined 11% and 5%, respectively, from mid-June to mid-July.

Responses to the individual questions used to calculate the indices indicated that the sentiment shift was primarily attributable to fewer respondents saying that 1) conditions were worse than a year earlier and 2) fewer saying that they expect bad times in the future.

Data collection for the July survey took place from July 15-19, 2024, which coincided with the dates for the Republican National Convention held in Milwaukee.

When asked about their biggest concerns in the year ahead, the top choice among producers once again was high input costs, chosen by 34% of respondents. However, weak commodity prices were also on producers’ minds, as 29% of producers in the July survey pointed to the risk of lower crop and livestock prices as a top concern, up from 25% of respondents in June. Only 17% of respondents cited rising interest rates as a top concern, down from 23% in June, consistent with signals from the Fed that interest rates have peaked.

Wrapping Up

The broad measure of farmer sentiment, the Ag Economy Barometer, climbed 8 points above the June reading as producers’ perspectives on both current conditions and the future improved. The sentiment improvement was puzzling in part because prices for principal commodities weakened from mid-June to mid-July, which could be expected to reduce farmers’ income.

In contrast to the sentiment improvement, producers confirmed that their farms’ financial condition was weaker than a year ago. Looking ahead, producers continue to express concerns about high input costs and declining prices for crops and livestock.

Producers in July were somewhat less concerned about the impact of interest rates on their farm operations, and that could be a reason why their outlook on capital investments improved modestly. Despite this month’s improvement in their investment perspective, farmers’ outlook on capital expenditures remained weak from both a long-term perspective and compared to a year ago.

Finally, looking ahead to 2025, nearly three-fourths of crop farmers in this month’s survey said they expect farmland cash rental rates to remain about the same as in 2024.

To read the entire report click here.