|

|---|

by Jonathan Coppess and Maria Kalaitzandonakes, Department of Agricultural and Consumer Economics, University of Illinois and Brenna Ellison, Department of Agricultural Economics,

Purdue University

Introduction

The final action of the 118th Congress was to enact a continuing resolution to fund the federal government through March 14, 2025. The legislation also extended the 2018 Farm Bill for another year through the 2025 crop and fiscal years. Finally, the bill provided supplemental appropriations for disaster relief.

Included in this supplemental appropriation was $30.78 billion in assistance to farmers, of which $10 billion is for “economic assistance” designed to make direct payments for economic losses based on the lower crop price projections and the rest in response to natural disasters (P.L. 118-158; see also, farmdoc daily, January 7, 2025; MPRNews, December 22, 2024; Blankenship, November 18, 2024). Extension of the Farm Bill for another year, rather than a full five-year reauthorization, coupled with another round of supplemental assistance to farmers and a change in administration, present many questions for farm policy (see e.g., farmdoc daily, December 13, 2024; November 13, 2024; October 30, 2024).

With those questions in mind, this article reviews public support for payments to farmers. The public – in their roles as taxpayers, voters, and consumers – are important stakeholders in agricultural policy. Here, we discuss results from the eleven waves of the Gardner Food and Agricultural Policy Survey, which has tracked public support for a variety of situations when farmers might receive financial support from the government, including during the 2024 presidential election.

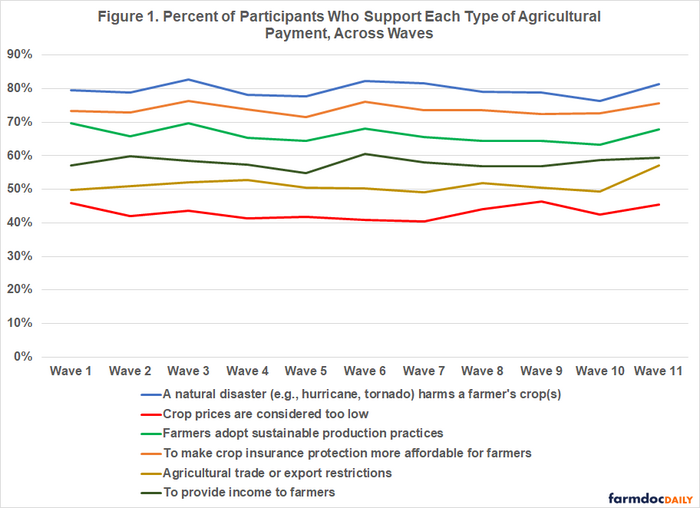

Our results show that the public has been broadly supportive of both payments following natural disasters and payments to subsidize crop insurance across time. Payments triggered by low crop prices have continued to have the lowest levels of support. Interestingly, while payments for farmers during export or trade restrictions has generally been relatively low across time, support for the payments rose in November 2024, perhaps driven by the increased salience of potential tariffs during the presidential campaign.

Methods

In this post we utilize results from the eleven waves of the Gardner Food and Agricultural Policy Survey (GFAPS). The survey has been conducted quarterly from May 2022 to November 2024 (which was conducted in the days following the 2024 presidential election). Approximately 1,000 U.S. consumers are recruited each wave to match the U.S. population in terms of gender, age, household income, and geographic region.

Survey participants were asked whether the government should provide financial support to farmers in six different potential situations: (1) a natural disaster (e.g., hurricane, tornado) harms a farmer’s crop(s), (2) crop prices are considered too low, (3) farmers adopt sustainable production practices, (4) to make crop insurance protection more affordable for farmers, (5) agricultural trade or export restrictions, (6) to provide income to farmers. The order of the situations was randomized to prevent ordering effects.

Results

For nearly three years, GFAPS has been tracking public support for different types of agricultural payments. The discussion that follows reviews two aspects of the findings during these eleven survey waves. First is a review of the overall responses and trends for payments to farmers. The responses over time add perspective to the recent supplemental payments. Second the discussion takes a closer look at support for payments due to trade conflicts in anticipation of the potential for additional tariffs and trade conflict in the second Trump Administration.

(1) Reviewing Public Support for Payments to Farmers

Figure 1 illustrates the GFAPS survey findings for payments to farmers since May 2022, including the most recent results collected following the 2024 elections. Responses have been generally consistent throughout the entire timeframe. The strongest support has consistently been payments for farmers in response to natural disasters, averaging 80% across all eleven waves. By comparison, the weakest support has consistently been for payments when crop prices are considered too low, averaging 43% across all eleven waves.

These results are particularly notable in light of the supplemental assistance enacted by the lame duck 118th Congress. Roughly one-third of the funds ($10 billion) are for economic assistance payments to farmers. These payments are in response to lower crop prices in the fall (which has lower public support), coupled with increased costs in recent years. The remaining two-thirds ($20.1 billion) of the funds are for assistance in response to natural disasters (which has high public support), especially the devastation caused by hurricanes in the fall.

Figure 2 provides additional perspective, showing actual payments to farmers since 2015 reported by USDA, as well as USDA and Congressional Budget Office forecasts for payments in 2024 and 2025 (USDA-ERS, “Data Files: U.S. and State-Level Farm Income and Wealth Statistics,” updated December 3, 2024; CBO, June 2024). The bars use colors to show the types of payments: red indicates farm programs (ARC/PLC), purple shows crop insurance net farmer benefits, green shows conservation (including IRA), and yellow shows ad hoc/supplemental payments. It also includes the net farmer benefit from crop insurance (total indemnities minus farmer-paid premium), which was calculated using the Summary of Business data (USDA-RMA, Summary of Business).

|

|---|

Conclusion

The GFAPS has been tracking public support for a variety of agricultural payment types for nearly three years. Public support for farm payments has renewed relevance with the $30 billion in supplemental assistance enacted by the lame duck 118th Congress and with a second Donald Trump presidency around the corner.

Results from the GFAPS show that the public is most supportive of payments following natural disasters and least supportive of payments in response to low crop prices. Interestingly, support for payments for farmers following export or trade restrictions saw an uptick in November, following the election. The increase in support was driven by changes in perceptions of Republican and Independent/Other participants, as Democratic participants had long had higher levels of support for these types of payments. It seems likely that these changes were driven by increased saliency of the issue during the presidential election.

Additionally, while this post discussed how tariffs may impact farmers, if enacted, they are also likely to have impacts on consumers. Previous research has shown that the cost of the 2018 tariffs were mostly borne by the nation’s consumers and firms (e.g., Amiti, Redding, and Weinstein, 2019, 2020; Fajgelbaum, et al. 2020; Cavallo, et al., 2021; Flaaen, Hortaçsu, and Tintelnot, 2019). Many US firms have indicated they expect prices to go up again if tariffs are levied. For example, a spokesperson for Walmart, a major food retailer, said they were “concerned that significantly increased tariffs could lead to increased costs for our consumers” (Nishant, Tiwary, and Saini, 2024). This is important for agriculture in particular, as consumers continue to report struggling with high prices for food (farmdoc daily, December 5, 2024)

The public – in their roles as taxpayers, voters, and consumers – are important stakeholders in agricultural policy; significant risk burdens policies that become misaligned with the public’s priorities and support. What this means for assistance to farmers, and any potential reauthorization of the Farm Bill, remains unclear at this stage but reviewing the results from the Gardner Food and Agricultural Policy Survey continues to provide perspective.

To read the entire report click here.