By Ryan Hanrahan, University of Illinois’ FarmDoc project

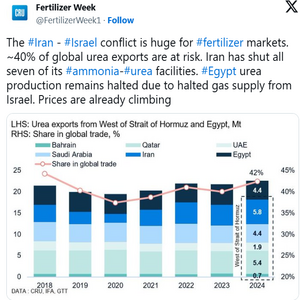

Agri-Pulse’s Oliver Ward reported that “renewed conflict in the Middle East has shuttered urea production in Iran, sending ripples through global fertilizer markets and adding to existing uncertainty around Russian and Chinese supplies, analysts tell Agri-Pulse.”

“Tensions flared between Iran and Israel on Friday when Israel launched what it called a preemptive missile strike targeting Iran’s nuclear program and military leadership. Four days later, both sides are reeling from attacks on key infrastructure and shuttered industries, including in the fertilizer sector,” Ward reported. “‘Iran has shut down seven of its urea and ammonia plants,’ said Mark Milam, senior editor for fertilizers at Independent Commodity Intelligence Services, over concerns that they could be potential Israeli targets.”

“Josh Linville, vice president of fertilizers at commodities analysis firm StoneX, said that attacks on the country’s natural gas infrastructure – which is used in the production of urea – is also keeping operations offline,” Ward reported. “Iran was the third-largest urea exporter in 2024, according to StoneX, with export volumes of around 4.5 million tons – about the size of China’s. The country has a production capacity of around 8.9 million tons a year, Milam added, serving markets in Turkey, Brazil and Argentina, among others. It is also an exporter of ammonia.”

“In addition to knocking Iranian urea production offline, the attacks also brought Egypt’s operations to a standstill,” Ward reported. “Israel reduced its natural gas flows to the country on Friday, prompting Egypt to cease production.”

AgWeb’s Margy Eckelkamp reported that “Linville’s colleague at StoneX, Arlan Suderman, details why this conflict is being watched so carefully if the concern isn’t in those two countries’ production. ‘There’s a lot of other producers of fertilizer in the Middle East and a lot of it also passes through the Strait of Hormuz, which will be at risk going forward now,’ Suderman says. From a global supply standpoint, Suderman also points out the Ukrainian attack of one of Russia’s largest nitrogen fertilizer plants two weeks ago.”

“With ongoing and new conflicts and strikes in key fertilizer production areas, Linville foresees needing to be focused on the potential outcomes,” Eckelkamp reported. “‘For now, we don’t believe there’s going to be much in the effect in terms of fertilizer production from either country, though it would be a little silly to not consider it, so we’re watching very, very closely,’ he says.”

Where the Conflict Currently Stands

NBC News reported that, as of Tuesday morning, “Israel and Iran launched a new round of attacks as the conflict between the two heavily armed rivals enters its fifth day.”

“Israel said it had killed Ali Shadmani, Iran’s new wartime chief of staff and the country’s most senior military commander. His predecessor was killed in Israel’s initial attack Friday,” NBC News reported. “…At least 224 people have been killed since Israel began bombing Iran on Friday, Iranian state media reported, while Iranian retaliatory strikes have killed at least 24 people in Israel.”

In addition, “President Donald Trump departed early from a Group of Seven summit in Canada to focus on the Israel-Iran conflict. In a joint statement, he and other G7 leaders affirmed Israel’s right to defend itself and said Iran is the ‘principal source’ of instability in the Middle East,” NBC News reported.

China’s Fertilizer Export Pullback Could Affect Prices, too

Ward reported that “compounding availability and price worries, the analysts said, is China’s continued pullback from exporting fertilizers. Both China’s phosphate and urea exports are lagging historical levels. China typically exports around 5.5 million tons of urea annually, but this year, Linville said, Beijing will only allow around 2 million in exports.”

“‘You’ve got so many different pieces,’ Linville said, driving uncertainty over urea supplies,” Ward reported. “U.S. farmers are somewhat insulated from short-term price shocks given many will not be buying fertilizer in earnest until later in the year. But Milam said that if supply uncertainties persist, it could create ‘all kinds of complications’ for U.S. buyers.”

“‘It’s hard to say whether that that’ll happen,’ Milam said,” according to Ward’s reporting. “China’s market retreat should be ‘a decent concern’ for farmers hoping for price stability come 2026, Linville said.”