By Ryan Hanrahan, University of Illinois’ FarmDoc project

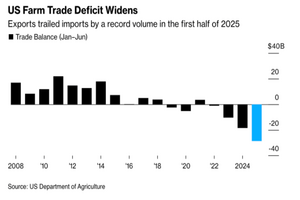

Bloomberg’s Gerson Freitas Jr and Ilena Peng reported that “the US agricultural trade deficit hit a record high in the first half of 2025, underscoring the continued decline of American farmers’ long-dominant role in global exports amid President Donald Trump’s trade wars. The value of agricultural exports trailed that of imports by $4.1 billion in June — a gap 14% wider than a year earlier — pushing the sector’s deficit to a staggering $28.6 billion for the first six months of the year, according to data released Thursday by the US Department of Agriculture.”

“The widening deficit marks a historic reversal for the US agricultural sector, which for the past five decades had consistently run major trade surpluses — even serving as a key foreign policy tool during the Cold War,” Freitas Jr and Peng reported. “The shift in fortunes began during President Donald Trump’s trade war with China in his first term, with the initial annual deficits recorded in 2019 and 2020. More followed, with negative flows seen over the past three years.”

“Limited capacity to further expand crop and livestock production and Americans’ growing appetite for imported produce have helped erode the balance. In addition, Trump’s trade wars have played a role, pushing China — the world’s largest crop importer — to rely more heavily on Brazil for its supplies,” Freitas Jr and Peng reported. “Some companies — including Brazilian beef producer Minerva SA — have increased shipments to the US ahead of Trump’s new tariffs. The US is also processing more of its crops domestically to produce biofuel, reducing exportable surpluses.”

While the ag trade deficit has widened, Reuters’ Dan Burns reported that the overall U.S. trade deficit “narrowed 16.0% in June to $60.2 billion, the Commerce Department’s Bureau of Economic Analysis said on Tuesday. Days after reporting that the goods trade deficit tumbled 10.8% to its lowest since September 2023, the government said the full deficit including services also was its narrowest since then.”

Falling Ag Exports to China Contributing to Ag Trade Deficit

Politico Pro’s Doug Palmer reported that “President Donald Trump’s trade war with China has taken a toll on U.S. agricultural exports to the world’s second-largest economy. U.S. trade data released Tuesday by the Commerce Department showed the United States exported just $5.5 billion worth of farm goods to China in the first six months of the year, compared to $11.8 billion at the same point last year.”

“The more than 50 percent drop in one of U.S. farmers’ largest export markets came as Trump hiked up tariffs on Chinese goods to more than 125 percent during the first months of the year, and China responded by imposing equally high tariffs on American goods,” Palmer reported.

A driver of the lower export sales to China in 2025 are the lack of soybean sales U.S. producers have made to the country. Zaner Ag Hedge’s Karen Braun reported at the beginning of the week that “as of July 24, US soybean exporters had sold just over 3 million metric tons of soybeans for export in 2025/26, which begins September 1. That volume is a 20-year low for the date and is down 12% from last year. New-crop sales are struggling because China has yet to buy a single cargo, and this is China’s latest start in the U.S. bean market since 2005.”

Ag Trade Deficit Projected to Continue Increasing

Agri-Pulse’s Philip Brasher reported at the beginning of June that “the Agriculture Department is projecting no improvement in the U.S. agricultural trade outlook for fiscal 2025 as the department lowered its forecast for livestock product exports, offsetting increases for grains and oilseeds. …The latest forecast projects that the ag trade deficit will grow to $49.5 billion for FY25, which ends Sept. 30, up from the $49 billion deficit projected in February and the $31.8 billion deficit recorded in FY24.”

“The deficit was $17.2 billion in FY23 after slight surpluses in FY21 and FY22 at $8.5 billion and $1.9 billion, respectively. There were slight deficits in FY19 and FY20,” Brasher reported. “USDA left its forecast for FY25 ag exports unchanged at $170.5 billion but raised its estimate for imports by $500 million to $220 billion, leading to the higher projected deficit.”