By Joana Colussi, Gary Schnitkey, Joe Janzen, and Nick Paulson, Department of Agricultural and Consumer Economics, University of Illinois

Brazil’s 2023 soybean exports reached a record of 3,744 million bushels, up 29% from the previous year as Brazilian production hit a new record. Meanwhile, the United States’ shipments declined 14% to 1,789 million bushels in the same period. The United States and Brazil are major competitors and together supply over 80% of soybean global exports, while China accounts for about 60% of total soybean imports. Soybeans are the largest agricultural commodity exported to China by both the United States and Brazil. Over the last five years, Brazil has become heavily reliant on Chinese import demand; 73% of Brazil’s exported soybeans have headed to China, versus a 51% average for the United States. The United States’ reduced reliance on exports to China allows for greater diversification compared to Brazil. This article examines the last 20 years of Brazilian and American soybean exports and provides perspective on the future of global trade in soybeans.

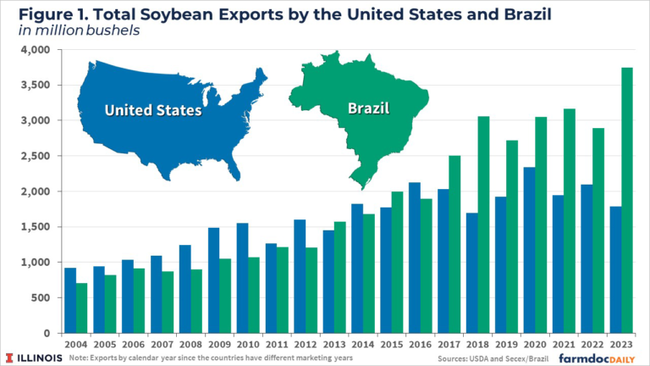

Brazil Soybean Exports Are Double the U.S.

Historically, the United States was the world’s largest soybean exporter. In 2013, Brazil surpassed the United States in soybean shipments for the first time. Since then, Brazil’s share of the global soybean trade has grown steadily, with Brazilian soybean exports reaching a record 3,744 million bushels for the 2023 calendar year, according to the Foreign Trade Secretariat (Secex). At the same time, American soybean exports were reduced to 1,789 million bushels, half the Brazilian soybean export volume, according to the U.S. Department of Agriculture (see Figure 1).

Over the last two decades, Brazilian soybean exports jumped fourfold (431%), from 705 million bushels in 2004 to 3,744 million bushels in 2023. The jump occurred mainly in the second decade. Soybeans have become Brazil’s primary agricultural export commodity by volume, accounting for more than 60% of the soybeans grown domestically. The Brazilian soybean crop for the 2022/23 marketing year was 5,680 million bushels, a historic record, according to the National Supply Company (Conab) – Brazil’s food supply and statistics agency.

Revenues from Brazilian soybean exports totaled a record $53.2 billion in 2023 versus $46.5 billion in the previous year, according to the Foreign Trade Secretariat (Secex). Considering the soybean complex, which also includes soybean oil and soybean meal, the revenue reached $67.3 billion in 2023, representing 40% of the total export revenue for the country. For the first time since the 1997/98 season, Brazil displaced Argentina as the leading global exporter of soybean meal due to severe drought, which cut Argentine soybean yields by half (see farmdoc daily, September 6, 2023).

Over the past two decades, U.S. soybean exports have increased 94%, from 922 million bushels in 2004 to 1,789 million bushels in 2023. The U.S. soybean exports have plateaued since 2016, with an average annual volume of 1,993 million bushels. The roughly doubling of exports occurred over the first decade and stagnated in the second decade.

Revenues from soybean exports totaled $27.9 billion in 2023 versus $34.4 billion in the previous year, according to the USDA. On average over the past five years, the United States has exported 49% of total soybean production. The soybean crop for the 2022/23 marketing year reached 4,160 million bushels, slightly lower than the previous year.

The decreased prominence of the U.S. in global soybean markets reflects in part the growth of domestic soybean demand. Soybean crush capacity in the United States has been steadily growing since 2021. According to the USDA’s latest World Agricultural Supply and Demand Estimates, projected domestic US soybean crush use for the 2023/24 marketing year (which runs from September to August) stands at 2,300 million bushels. This expansion is primarily fueled by the increasing demand for soybean oil, particularly from the renewable diesel sector. The US Environmental Protection Agency (EPA) continues to enforce biofuel blending targets for refiners and gasoline or diesel fuel importers, further driving this demand (see farmdoc daily, November 13, 2023).

To read entire article, Click Here