Source: Organic Produce Network staff

In 2024, organic fresh produce experienced a remarkable year, with sales reaching $9.5 billion–an increase of 5.7% from the previous year. Once again partnering with Category Partners, Organic Produce Network has compiled an annual report, State of Organic Produce 2024, showcasing the top-performing organic produce categories, plus key factors influencing sales of organic produce.

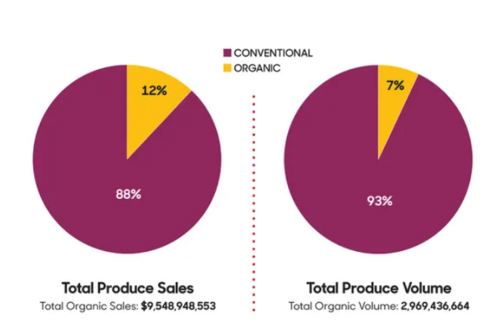

Organic now comprises 12% of total retail produce sales and 7% of overall produce volume, reinforcing its expanding influence in the market. Organic produce volume grew by 6.1%, surpassing the 2% volume growth of conventional produce. Across all four U.S. regions, organic produce sales saw year-over-year gains, with the South leading at 7.2% growth.

Top-performing categories

Organic berries led in sales for the third consecutive year, reaching $1.857 billion–a substantial 11.8% increase from the previous year. With 268 million pounds sold, berries ranked third in volume behind bananas (613 million pounds) and apples (281 million pounds). Packaged salads followed berries with $1.446 billion in sales, while apples ranked third at $708 million. Notably, organic berries maintained a 66.6% price premium over conventional counterparts, reflecting strong consumer demand.

Top 10 organic produce categories by sales:

Berries – $1.857B

Packaged Salads – $1.446B

Apples – $708M

Herbs & Spices – $494M

Bananas – $492M

Carrots – $446M

Lettuce – $382M

Potatoes – $354M

Tomatoes – $333M

Citrus – $303M

Top 10 organic produce categories by volume:

Bananas – 613M lbs

Apples – 281M lbs

Berries – 268M lbs

Carrots – 257M lbs

Packaged Salads – 180M lbs

Potatoes – 177M lbs

Citrus – 106M lbs

Onions – 102M lbs

Herbs & Spices – 94M lbs

Lettuce – 90M lbs

Retailer and wholesaler insights

Despite ongoing inflation, its impact on organic sales was less severe than in 2023. Climate-related disruptions, however, posed increasing challenges for supply and pricing. Retailers responded with strategies to maintain competitiveness, such as improving consumer education and ensuring organic options remained attractive.

Competitive pricing and premium product presentation remain crucial factors in driving organic sales. “While organic pricing doesn’t need to exactly match conventional produce pricing, it should be competitive enough to entice shoppers to opt for the organic option,” notes Tom Barnes, president and CEO of Category Partners. Meanwhile, shifting shopping behaviors favor organic produce, as Jonna Parker, team lead for fresh foods at Circana, observes: “People shopping ‘just in time’ are making more trips to stores for fewer things, and produce is making it into the baskets on those small trips.”