Lowering Commodity Prices Demand More Protections

Is ECO the answer? Producers have their eyes glued on the commodity markets and are rightly concerned to see prices have substantially dropped from last year. Soybeans have seen 8 straight weeks of price drops. Taking last year’s crop insurance plan with a copy-and-paste strategy for 2024 is unlikely a good risk management choice. With commodity prices being lower, how do you protect your operation in new ways? Producers may want to consider an additional layer of protection on top of the base MPCI policy, called Enhanced Coverage Option (ECO).

ECO with Price Drops

ECO is particularly relevant when base prices start at a low level. In contrast to Multiple Peril Crop Insurance (MPCI) which requires a significant drop in commodity price or farm yield to claim a loss, ECO does not require such a substantial drop to owe a loss payment. ECO protects up to 95% of county revenue. This aspect makes ECO an essential tool for managing the risk of minor decreases in yield or price. ECO provides protection against large commodity price drops as well. ECO locks in a higher revenue level, ensuring that if prices fall significantly, the loss payout will also be substantial. This feature is invaluable in managing the volatility of commodity markets.

How are ECO Loss Payments Affected by Falling Prices?

ECO protects up to 95% of county revenue. That means with only a 5% drop in price, loss payments begin being paid out. Let’s take a look at examples for Brookings County, South Dakota. We will only look at how the price changes a ect payments holding all other elements, such as county yields, constant. The final projected base prices will be set in the first days of March after the Discovery Period is over but will be within a few cents of these current numbers.

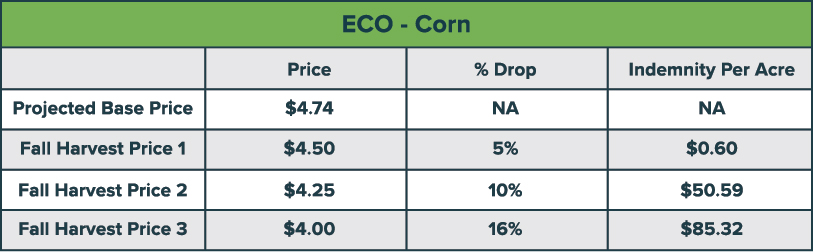

Corn

Looking at corn with a base projected price of $4.74, indemnity payments begin at $4.50. There is a modest payment of $0.60 per acre at this price drop but payments increase rapidly from there. At a 10% drop, indemnity payments are at $50.59 per acre. While prices are not expected to fall this much, at a 16% price drop ECO pays out $85.32 per acre.

Soybeans

Looking at soybeans, the commodity price has been in a long downslide. The base price is going to be set a couple of dollars away from last year’s high close to $11.73. At a 5% drop in price during harvest, there will be a $1.86 indemnity payment per acre. At an 11% price drop, payments increase to $35.94.

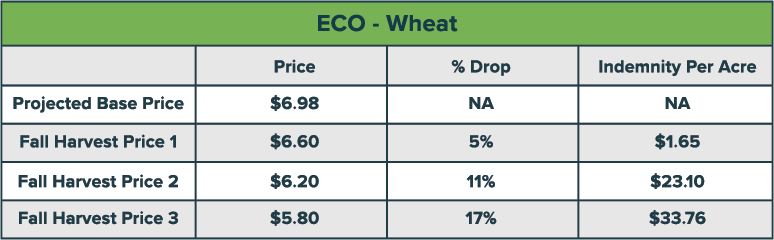

Wheat

Wheat has also seen a large price drop since last year. Projected base prices to start the ECO policy will be close to $6.98. With the 5% wheat price drop, indemnities in this county example will be paying $1.65 per acre. With a harvest price of $6.20, the indemnity loss payments increase to $23.10. At a 17% price slide, the indemnities increase to $33.76 per acre.

With a starting point of up to 95% county revenue, the larger the price drop, the higher potential for significant indemnity loss payments.

How Does ECO Compare to Margin Protection?

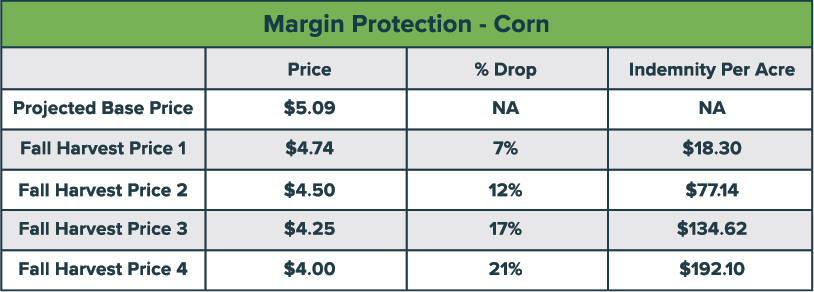

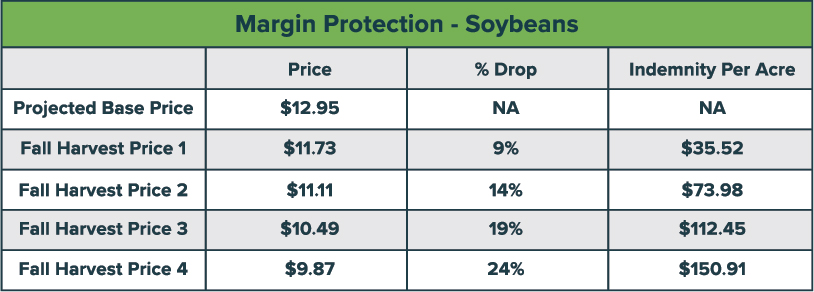

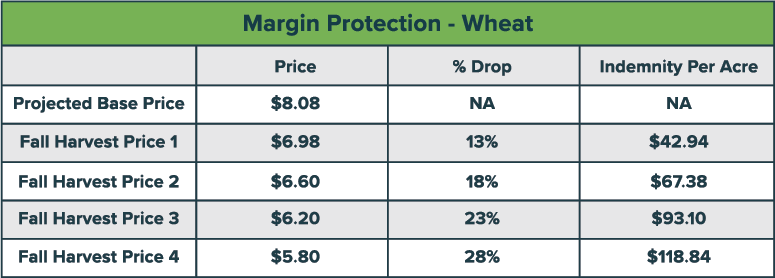

Precision Risk Management recommended Margin Protection (MP) for many customers last year before the 9/30 federal signup deadline in anticipation of the price drops. These policies were locked in with higher commodity base prices at that time with corn at $5.09, soybeans at $12.95, and wheat at $8.08. At current prices, Margin Protection (MP) policies are looking like they will be paying loss payments and helping producers cover the drop in their revenue.

Comparing ECO to MP indemnity payments, MP is going to have significantly larger payments owed to producers. You can see in the charts below the Margin Protection payments. This assumes all elements besides commodity prices stay the same. These higher payments also came with higher premium costs. Margin Protection was up to $50 per acre in premium. ECO is closer to $20-$30 per acre depending on the county.

While it is too late to enroll in Margin Protection for this year, it is not too late to enroll in ECO. ECO is the last opportunity for 2024 for the upper-tier price protection. Once 3/15 is passed, producers will be locked into price drops until their SCO, ARC or underlying MPCI policy level is met.

Historical Commodity Price Changes

Producers are facing a very different commodity price landscape from last year in 2023. Corn projected base prices were set at $5.91 and soybeans at $13.76. Both prices say a significant price drop at harvest. We are below those levels today. The chart to the right shows the historical comparisons between projected and harvest prices.

Evaluate with a PRM Advisor

Each farm operation is unique, with specific needs and risk profiles. PRM Risk Management Advisors can help you determine whether ECO is the right fit for your operation, considering factors like your crop mix, financial goals, and risk tolerance. They will work with you to analyze historical price movements, current market trends, and provide a county-specific quote. ECO is not a right fit for all operations but it is important to make sure you know how it could protect your operation in a detailed analysis.