A study on optimizing PRF Insurance

Optimized PRF Insurance increased returns by 99%

What’s an Interval?

Intervals are two-month periods a producer will have coverage for precipitation shortfalls. Producers select a minimum of two to a maximum of six intervals. The allocation of coverage percent per interval is also selected and distributed across all intervals, to equal 100%. If an interval triggers an indemnity but was not selected by a producer no indemnity will be paid. This makes choosing the intervals with the largest chance of a loss essential to maximize a policy.

What Does PRM Do?

Precision Risk Management puts each policy through the PRF Optimizer to find the interval periods that will create the largest probability of indemnity payments. Back with our systems, our Advisors analyze historical data to find the most efficient combinations of interval period selections.

Case Problem

A rancher needed PRF Insurance protection but did not see it being a good investment of capital. Chosen at random, the interval periods were producing negative returns costing more in premium than indemnity. Both odd and even selections had around a $1000 loss on 1000 acres. No PRF insurance was purchased and left the operation unprotected.

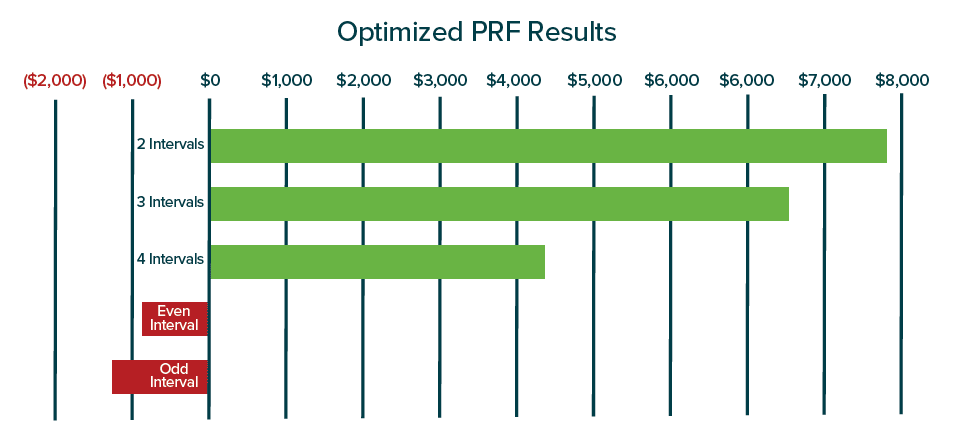

Optimized Results

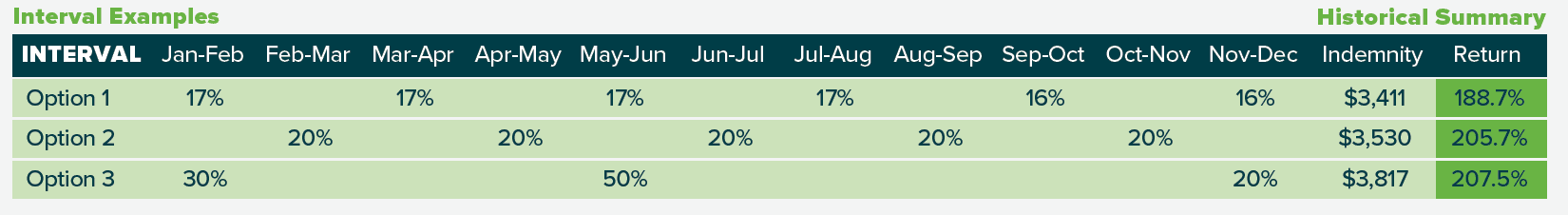

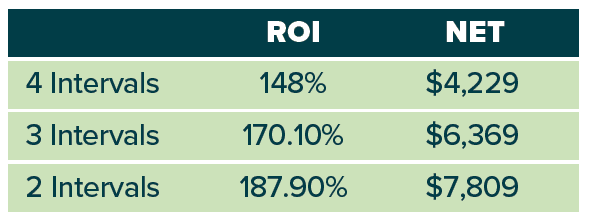

Precision Risk Management put the policy through the PRF Optimizer to see if the area has the potential for a likely return. Three combinations of intervals with equal coverage allocation were found to create a significant return.

With the PRF Optimizer returns increased up to 99%.

A negative indemnity of -$1,041 turned it into a positive return of up to $7,809