By Bernt Nelson, Economist, American Farm Bureau Federation

Year-over year increases in grain stocks are unwelcome news for corn and soybean farmers, who are poised to harvest record crops in the coming weeks. Commodity markets, though, had a mixed- response to USDA’s Sept. 1 grain stocks and inventory estimates, released today.

The quarterly Grains Stocks report contains estimates for corn and soybean ending stocks for the 2023/2024 production year. This is a highly anticipated report for farmers because it provides firm estimates of the 2023/2024 crop (old crop) being stored both on and off the farm for all wheat, durum wheat, corn, soybeans, sorghum, oats, barley, flaxseed, canola, rapeseed, rye, sunflower, safflower and mustard seed by states and by position (both on-farm and off-farm storage).

In its September Farm Income forecast, USDA estimated cash receipts for crops will suffer a $27.7 billion, or 10%, drop from 2023. These price drops pushed many farmers to store grain in hopes of receiving a better price, but with no improvement in prices and harvest underway in key production regions, farmers will need to make room for the incoming crop. This Market Intel will provide insights into what the Sept. 1 Grain Stocks report means for the market, both in the short and long term.

Corn

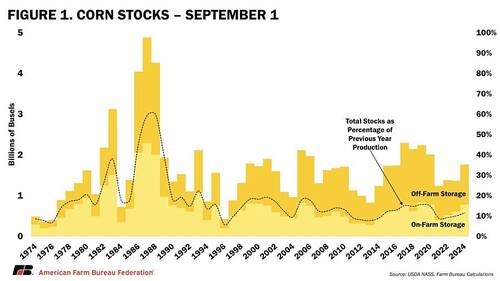

Old crop stocks of corn (corn from the previous crop year) are estimated to be 1.76 billion bushels, up 29% from last year. Of these stocks, 780 million bushels are being stored on-farm, up 29% year over year. The other 980 million bushels are being stored off-farm, up about 30% year over year. June through August disappearance is estimated to be 3.24 billion bushels, up 19%, or 530 million bushels, from 2.74 billion bushels during the same period in 2023. 2023 corn for grain production was reduced by 1.08 million bushels, while corn for silage production was reduced by 140,000 tons due to reduced harvested acreage.

Soybeans

Old crop stocks of soybeans are estimated to be 342 million bushels, also up 29% from last year. Soybeans stored on farms totaled 111 million bushels, up a shocking 54% year over year, while off-farm storage totaled 231 million bushels, up just 20% from last year. June through August disappearance was estimated at 628 million bushels, up about 18% from the same period in 2023. Production was adjusted down 2.62 million bushels due to reduced harvested acres.

Wheat

All wheat in storage, both on and off farm, totaled 1.99 billion bushels, up 12% from Sept. 1, 2023. Wheat stored on farm was estimated to be 664 million bushels, up 11% year over year, while off-farm stocks were 1.32 billion bushels, up 13% year over year.

Storage, Delivery and Basis

The initial market response to the grain stocks data was slightly bullish because many industry trade experts were expecting higher estimates for stocks of corn, soybeans and wheat. With a record corn and soybean crop forecast for 2024/2025, higher stores of these crops are concerning because farmers will need to make sales to deliver old crop in order to make room for incoming new crop. Elevators will need to make sales of old crop to make room for both new and old crop being delivered by famers. When there is a large flood of products sold at one time, it can cause elevators to fill up, leading grain buyers to adjust the local basis.

Basis represents the difference between the local cash price of a commodity that a producer receives and its corresponding futures price. When it becomes difficult or more costly for a buyer to move grain, basis widens. Up to this point, basis has not been very volatile but there are several events on the horizon that could cause this to change. Damage caused by hurricane Helene has caused turmoil in the Southeast, and there is the risk of shipping disruptions from a looming port strike. Another event that could widen basis is a high volume of grain being delivered to make room for the incoming harvest. Any one of these events could cause basis to widen; in this case a widening negative basis reduces the price received by farmers, who are already feeling the pain of lower commodity prices in 2024.

Conclusions

The market responded somewhat positively for corn, with December futures closing up 6 cents per bushel at $4.24. On the other hand, November soybean futures, dropped 8 cents to $10.57 due to the massive 54% year-over-year increase in old crop being stored on-farm. The big picture is that corn and soybean stocks are both up nearly 30% year over year with a record crop about to be harvested. This has the potential to increase stocks again next year while demand remains the same at best.

While the carry in the market is offering some short-term marketing opportunities, this is very bearish news for next year. With this much grain in storage, farmers and grain buyers will need to market crops to make room for the incoming harvest. If there is a large flood of any crop headed to market, it can reduce the local basis or even cause buyers to stop taking delivery all together, further reducing farmers’ bottom lines.