By Jacqueline Holland, Farm Futures magazine

Corn and soybean acreage will shift across the U.S. in the spring of 2024, but perhaps not by as much as what market prices are currently forecasting.

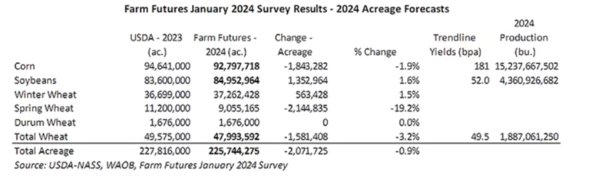

The Farm Futures January 2024 grower survey, conducted via email Dec. 18, 2023 through Jan. 2, 2024, gathered acreage intentions for this spring from 825 respondents across the Heartland. Despite the market indicating a strong preference for soybean acres this upcoming spring, farmers are indicating only slight changes in corn and soybean acres.

Farmers indicated 2024 corn plantings would dip nearly 2%, or 1.8 million acres, from year ago sowings to 92.8 million acres this spring. Rotations are expected to remain consistent throughout the Corn Belt, but bigger losses are expected outside of that region, particularly in areas where fall 2023 fertilizer prices may have been more expensive and/or less available.

Barring any weather hiccups, USDA projects 2024 trendline corn yields at 181.0 bushels per acre. Using that calculation, U.S. corn farmers could harvest 15.238 billion bushels of corn this fall, down less than a percent from last year’s record-setting crop of 15.342 billion bushels.

The 2023 U.S. corn harvest provided the market with more supply liquidity than it had experienced since China’s grain buying spree in 2020. But without significant upticks in domestic and global usage rates of U.S. corn, farmers could face further price falls as supplies grow.

December 2024 corn prices fell 17% during the 2023 calendar year as record-breaking U.S. and Brazilian corn crops flooded the world with plentiful exportable corn supplies. Thanks to more affordable inputs in the U.S. last fall, many growers were hesitant to back away from regular corn rotations even as domestic usage of soybeans continues to rise.

In the first three weeks of the 2024 calendar year, December 2024 corn prices are already trading 5% below where they started the new year following the news of surplus U.S. stocks. Markets are waiting for further price direction from Brazil, where a late-planted soybean crop and early season drought could limit acreage and provide more profit opportunities for U.S. corn growers this spring.

Soybean boom or bust?

Growers in the Farm Futures survey expect to plant 85.0 million acres of soybeans this spring, up 1.4 million acres, or 1.6%, from a year ago. It would be the fifth-largest soybean crop planted in the U.S. if realized.

Using USDA’s trendline yield of 52 bpa, 2024 U.S. soybean production would rise nearly 5% on the year to 4.361 billion bushels – the country’s fourth-largest soybean crop. Most of the acreage will likely come from expected rotation shifts within the Corn Belt, as well as larger shifts from outside the region. Specifically, growers in North Dakota, where the ADM Spiritwood plant came online last fall, are projecting a 5% increase in planted soybean acreage this spring.

To read entire article, Click Here