|

|---|

Source: Purdue University

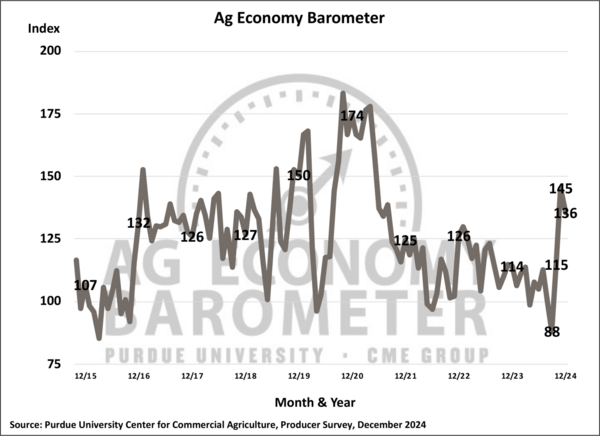

Farmer sentiment drifted lower in December as the Purdue University-CME Group Ag Economy Barometer fell 9 points to 136. Although the barometer weakened somewhat in December compared to November, producers still retained much of their post-election optimism about the future. The Index of Future Expectations dropped just 8 points to 153, leaving that index 59 points higher than in September and 29 points above the October reading.

The Index of Current Conditions declined 13 points to 100, indicating that producers’ appraisal of current conditions in U.S. agriculture and on their farms is weaker than their views regarding the future. Despite this month’s decline, the Current Conditions Index remains 24 points above its September low and 5 points higher than in October. Optimism about the future appears to be motivated primarily by producers’ expectations for a more favorable policy environment in the years ahead.

The December barometer survey took place from December 2-6, 2024.

Farmers’ views about the current situation and the one-year ahead outlook differed noticeably from their five-year ahead outlook. Overall, responses to questions focused on the current situation and outlook over the next 12 months were weaker than a month earlier, while responses to questions focused on the outlook over the next five years tended to be more positive than in November.

For example, the percentage of respondents who expect widespread good times in U.S. agriculture over the next five years rose to 57%, up from 52% a month ago and 34% in October. The expectation for good times extended to both the crop and livestock sectors, with the percentage of respondents expecting good times increasing by 4 points for crops and 5 points for livestock.

However, when asked about financial conditions on their farms today compared to a year ago, the percentage of respondents reporting worse conditions today rose to 57% in December compared to 51% in November. When asked for their outlook for the U.S. agricultural economy over the next 12 months, 51% of producers in December said they expect bad times compared to 40% of respondents who felt that way in November.

The Farm Capital Investment Index fell 7 points in December to a reading of 48. This month’s decline came on the heels of a 13-point rise in November. The percentage of respondents who said it’s a good time to invest declined to 17% compared to 22% a month earlier, while the percentage of farmers who said it’s a bad time for investments rose slightly to 69%, up from 67%. The investment index’s decline mirrored that of the Farm Financial Performance Index, which fell 8 points in December to 98.

To read the entire report click here.

|

|---|