By Ryan Hanrahan, University of Illinois’ FarmDoc project

Champagne, IL – Bloomberg Law’s Alex Wolf and Skye Witley reported in April that “family farm bankruptcies increased by 55% last year compared to 2023 and are trending even higher this year as farmers continue to grapple with depressed agricultural commodity prices and high input costs.”

“And while much of the industrywide distress predates his second stint in the White House, (President Donald) Trump has quickly nudged more farmers closer to the brink of going under and created turbulence for producers trying to make ends meet,” Wolf and Witley reported. “Unpredictable tariffs, immigration overhauls, federal program cuts and frozen Agriculture Department funding are now part of the discussions farmers are having as they seek financial help.”

“Filing under Chapter 12 of the federal bankruptcy code gives farmers and family fishermen an opportunity to propose and carry out a plan to repay all or part of their debts,” U of Arkansas System Division of Agriculture Mary Hightower reported. “…Chapter 12, introduced in 1986 at the height of the farm crisis, was designed with farms in mind and offers an alternative to a Chapter 7 filing, which a farm’s assets are liquidated to pay creditors.”

Why Are Bankruptcy Filings Increasing?

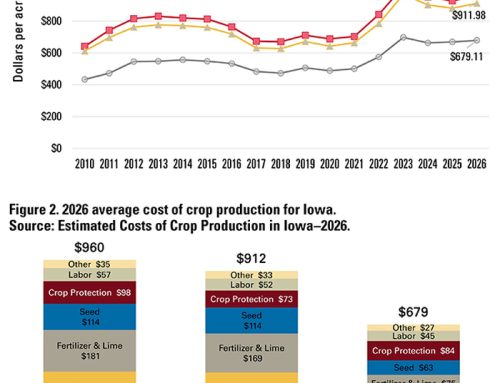

“A large part of the pressure stems from the fact that ‘commodity prices are back at levels where they were in the 2018-2019 era,’ said Scott Stiles, extension economics program associate for the Division of Agriculture,” Hightower reported. “Adding to the pressure cooker are input costs — seed, fertilizer, pest management tools and diesel — that never seem to decline much or for a long period.”

“‘There are (also) concerns about the trade environment that we’re in,’ Stiles said,” according to Hightower’s reporting. “‘There have certainly been a lot of weather challenges.'”

AgWeb’s Margy Eckelkamp reported that “with higher input costs and lower commodity prices, row crop farmers have used cash reserves and working capital.”

“‘It tough because it’s [working capital] already been burnt through, and that’s your first offense against commodity price volatility,’ (Ag Resource Management’s Ashley) Arrington says,” according to Eckelkamp’s reporting. “‘I saw last year when cash was really starting to get depleted, and some people who should have addressed their problems last year, kicked the can down the road. And then this year, we can’t get anything done for them because it’s just too far upside down.'”

“…When asking ARM farmer customers who didn’t renew business with the ag lender the reason why, it wasn’t because they switched lenders,” Eckelkamp reported. “‘When we were asking that question, ‘why haven’t these people applied with us again?’ one of the biggest reasons why is they were no longer farming, and that’s the largest amount I’ve really ever seen in my career,’ Arrington says.”

Loan Repayment Rates Lower Compared to Last year

The Federal Reserve Bank of Chicago’s David Oppedahl and Elizabeth Kepner wrote in May that “district agricultural credit conditions weakened during the first quarter of 2025. Repayment rates for non-real-estate farm loans were much lower in the January through March period of 2025 compared with a year ago, and the renewals and extensions of these loans were higher.”

“In the first quarter of 2025, demand for non-real-estate farm loans relative to a year ago was up for the sixth consecutive quarter, while the availability of funds for agricultural lending relative to a year earlier was down for the eighth consecutive quarter,” Oppedahl and Kepner reported. “At 61 (its lowest value since the first quarter of 2020), the index of repayment rates for non-real-estate farm loans was down from a year ago for the sixth consecutive quarter; 39% of responding bankers observed lower rates of repayment for the first quarter of 2025 relative to the first quarter of 2024, and no bankers observed higher rates.”