Source: Farm Futures survey news release

ST. CHARLES, ILL. — While commodity price trends suggest an increase in corn planting intentions, U.S. farmers remain committed to their crop rotations, prioritizing agronomic stability over market fluctuations and policy changes, according to the latest Farm Futures survey.

The survey, conducted by Farm Futures, a Farm Progress publication, indicates that large family farmers with substantial corn and soybean acreage, the predominant audience for the national magazine, are staying the crop rotation course rather than following grain market forecasts. Only 13% reported changing their acreage intentions due to commodity price trends over the last two months.

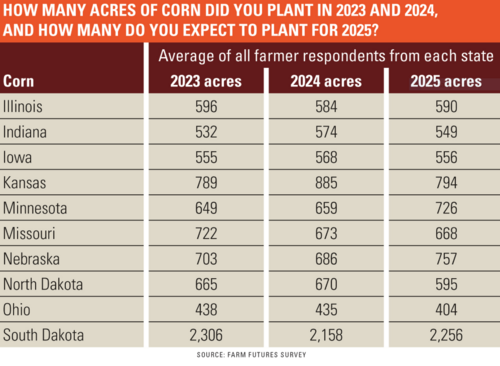

Corn acreage adjustments vary by state

Despite earlier USDA forecasts of 94 million acres of corn and trade estimates exceeding 95 million, the Farm Futures March survey suggests these projections may be high. Among respondents in the top 10 corn-producing states, half reported a decrease in planted corn acres. Looking at Illinois and Iowa, which together grow about one-third of the corn produced in the U.S., the survey shows the market isn’t buying many acres:

In Illinois, the average number of corn acres is up by 6 to 590 acres on average per farmer respondent.

Iowa farmers dropped their average from 568 acres to 556, nearly level with their 2023 corn acreage.

“The ratio of new crop soybean to corn futures is around 2.25-to-1, giving only a slight advantage to corn,” Bryce Knorr, Farm Futures editor emeritus, said. “Generally, a 2-1 ratio buys lots of corn and a 2.5-1 ratio buys soybeans.”

Knorr noted that both crops could ultimately be financial loss leaders.

“When accounting for total economic costs, including family labor and capital, each crop is currently projecting a negative return of approximately $120 per acre,” he said. “At current new crop futures prices and expected costs per acre from USDA, it’s a dead heat on expected loss per acre.”

Long-term planning over market reactions

Three-quarters of the surveyed farmers cited agronomic benefits as the primary reason for maintaining their crop rotations. More than half reported that their rotations are fixed, while 38% indicated that their opportunity to shift acreage is limited to less than 25% of their planted acres.

“What we’re seeing is that farmers are looking deeper into their operations. They are focusing on long-term advantages,” Pam Caraway, Farm Futures executive editor, said. “With a good crop rotation, both grains are more likely to show higher yields with lower input costs. Long term — and farmers think in generational pictures — the advantages to the land and the economics of the operation are higher with a good crop rotation.”

Ultimately, however, more than a third are concerned about market conditions, and 39% worry about whether they can pay their debt.

“At the end of the day, these farmers are leading multi-generational family businesses,” Caraway said. “And their goal is to ensure the family farm survives under their watch.”

Trump triumphs

These farm leaders also are holding firm on their politics, with 36% of respondents rating President Donald Trump’s performance “better than expected.” And nearly half rate Trump’s performance as “about what I expected.” Only 18% downgraded his performance.

Though trade disputes and weak grain prices are their greatest concern, these farmers find hope in expanding export markets and reduced government regulation. Overall, according to the Farm Futures survey, farmers are more concerned about the weather than market conditions or federal government disruption.

One wrote in that the worry is “intolerance of short-term pain needed to fix problems.”

Then again, another said “can’t see anything he’s doing so far [that’s] helping. Everything is more expensive, and crop markets have tanked.”

Farm Futures, the trusted advisor for agricultural leadership, serves large-scale farm operators with business-oriented content. It provides expert insights and analysis to help farmers navigate production and financial decisions. The publication will conduct its next farmer survey in August.

For more information, visit www.farmprogress.com/farm-futures.