Margin Protection

Margin Protection, also called MP, guarantees you will maintain your desired operating margin. It covers against an unexpected decrease in operating margin (revenue less input costs). Margin Protection provides both yield and price protection meaning lower county yields, reduced commodity prices, increased prices of inputs such as fertilizer can all lower your operating margin enough to cause a payout.

Main Details

Stand-Alone Policy

MP can be bought by itself without an underlying Multi-Peril policy. Many growers do pair this coverage with a Yield Protection or Revenue Protection policy but this causes indemnity offsets.

Area-Based

MP is based on the county level of expected revenue. Individual grower’s performance does not determine the coverage payout, but by all their neighbors’ combined performance. A well-performing grower can still receive a loss payout under this policy, depending on their county.

9/30 Sign Up Deadline

The Sales Close Date is 9/30, which is earlier than a standard MPCI policy. The price discovery period is from Aug 15 – Sept 14.

Federally SUBSIDIZED

Margin Protection is not a private insurance product. The federal government subsidizes it by around 50%, depending on coverage level

Watch the MP Explainer Video

Benefits

Up to 95% Levels

Coverage selection starts at 70% up to 95%. This is higher than the maximum 85% of multi-peril policies such as Yield Protection.

Input Coverage

Protects the grower from increased costs outside of the grower’s control.

Create a Floor of Revenue

Depending on the performance of the county, a grower has a safe level of revenue for the crop season. A Margin Protection payout can exceed $1,000 per acre.

Can Lock in Prices Early

When commodity prices are higher than average, a grower can lock in high expected commodity prices when they purchase the policy. The Discovery Period is from August 15th-Sept 14th.

Premium Credit

When a grower purchases a Yield Protection or Revenue Protection policy, there is a discount on the Margin Protection. This is because there are coverage overlaps.

How is Payout Calculated?

Margin Protection is one of the more complicated coverage options in determining when a payout will be determined. We will look at it from a high level for illustration purposes.

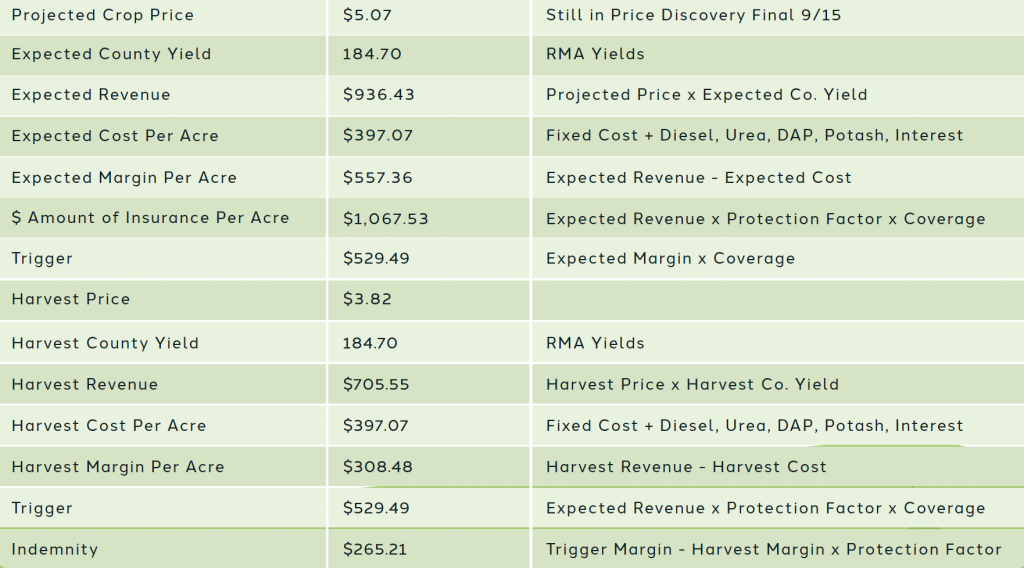

Expected Margin with deductible – Harvest Margin = Margin Loss

Margin Loss X Coverage Protection Factor = Indemnity Payout

Detailed Example of Possible Scenario

Precision Risk Management’s Policy Support Team modeled a potential scenario based on trends from previous crop years to illustrate how a MP policy would work. A grower in South Dakota buys a Margin Protection Policy with 95% coverage level and a 120% protection factor for non-irrigated corn. In this example, the commodity price will drop 22.3% like it did in 2013. The indemnity payout would be $265.21 per acre, in this South Dakota county.

Examples of Guarantees

As Margin Protection is an area based coverage, the expected county yields is a main competent in determining the guarantees. We are highlighting certain counties in the state to illustrate Margin Protection guarantees at 95% levels.

These examples of guarantees were built for illustration of prices from previous crop year for the different counties. See a Risk Management Advisor for your county’s guarantee for this year’s commodity prices.

Projected Price x Expected County Yield x (1 – Coverage level) = Estimated Guarantee*

*A Risk Management Advisor will provide you an exact quote for your county taking into account all MP factors and calculations. Estimated Guarantees are simplifications and only for illustration purposes.

Drawbacks

More Premium

The more coverage a policy adds, the more in premium will be owed. It will be up to the individual grower to determine if the premium fits their risk management strategy.

No Catastrophic Level of Coverage is Available

Not all Crops and States/Counties Have Coverage Options

The USDA’s site has a list of all crops and states availability found here.

Your Neighbor’s Situation can be Very Different than Yours

There can be a lot of variability in a county and Margin Protection is area-based.

It’s easy to get Margin Protection (MP), Enhanced Coverage Option (ECO), and Enhanced Margin Coverage Option (MCO) confused.

At first glance, these products might look nearly identical. They all offer coverage above 80% levels, aim to protect revenue and margin, and are often used in tandem with your underlying Revenue Protection (RP) policy. But the differences on how each one works, when they’re triggered, and how they pair with your operation’s risk profile can make all the difference in your bottom line.