A revenue protection (RP) crop insurance plan provides financial protection to farmers if the market value of their crops is lower than expected. This type of insurance plan is designed to help farmers protect their income and ensure that they can continue to operate their farms even if they experience a drop in crop prices.

The farmer pays a subsidized premium to the insurance company. The premium is based on the coverage level selected and the value of the insured crop. If the actual revenue is lower than the guaranteed revenue, the farmer can file a claim with PRM to receive payment for the difference.

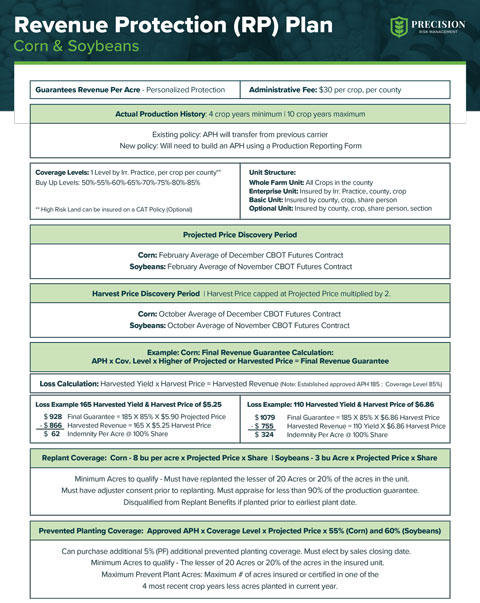

Guarantee Calculation

Approved APH x Coverage Level x Projected Price = Value Production Guarantee

Covered Causes of Loss

Decline in price, adverse weather conditions, fire by natural causes, insects (but not damage due to insufficient or improper applications of pest control measures): plant disease (but not due to damage due to insufficient or improper application of disease control measures), wildlife, earthquake, volcanic eruption, failure of the irrigation water supply (if applicable, due to an unavoidable cause of loss occurring within the insurance period).

Not Covered Causes of Loss

Negligence, mismanagement, or wrongdoing by you or any member of your family or household, your tenants, or employees; failure to follow recognized good farming practices for the insured crop; water contained by any governmental, public, or private dam reservoir project; failure or breakdown of irrigation equipment or facilities; or failure to carry out good irrigation practices for the insured crop, if applicable.

Replant Coverage

Corn – 8 bu per acre x Projected Price x Share

Soybeans – 3 bu acre x Projected Price x Share

Minimum Acres to qualify: must have replanted the lesser of 20 acres or 20% of the acres in the unit.

Must have adjuster consent prior to replanting. Must appraise for less than 90% of the production guarantee.

Disqualified from Replant Benefits if planted prior to earliest plant date.

Prevented Planting Coverage

Approved APH x Coverage Level x Projected Price x 55% (Corn)/ 60% (Soybeans)

Can purchase an additional 5% (PF) additional prevented planting coverage. Must elect by sales closing date.

Minimum Acres to qualify: the lesser of 20 Acres or 20% of the acres in the insured unit.

Maximum Prevent Plant Acres: maximum # of acres insured or certified in one of the four most recent crop years less acres planted in current year.

Yield Protection vs Revenue Protection Differences

A crop insurance yield protection (YP) option provides financial protection to farmers if their crops produce yields that are lower than expected. In contrast, a crop insurance revenue protection (RP) option provides financial protection to farmers if the market value of their crops is lower than expected.

Here’s how these two types of insurance plans differ:

Yield protection (YP)

With a yield protection insurance plan, the farmer is protected against the risk of poor crop yields. The insurance pays out if the actual yield is lower than the expected yield, providing the farmer with some financial compensation for the loss of income.

Revenue protection (RP)

With a revenue protection insurance plan, the farmer is protected against the risk of low crop prices. The insurance pays out if the market value of the crops is lower than the expected value, providing the farmer with some financial compensation for the loss of income.

A yield protection (YP) insurance plan focuses on the physical quantity of the crops produced, while a revenue protection (RP) insurance plan focuses on the market value of the crops. Both types of insurance plans can help farmers to protect their income and maintain the viability of their farms.

Download Our RP Product Guide