Crop Insurance 101

Crop insurance is the backbone of a risk management strategy for successful operations. Too many operations treat crop insurance as a simple choice of which levels to choose each year. Last year’s growing season was vastly different from this year’s crop prices, weather, input prices, and more. A crop insurance plan shouldn’t be carried over to protect last year’s risk.

Standard Quote. Standard Protection

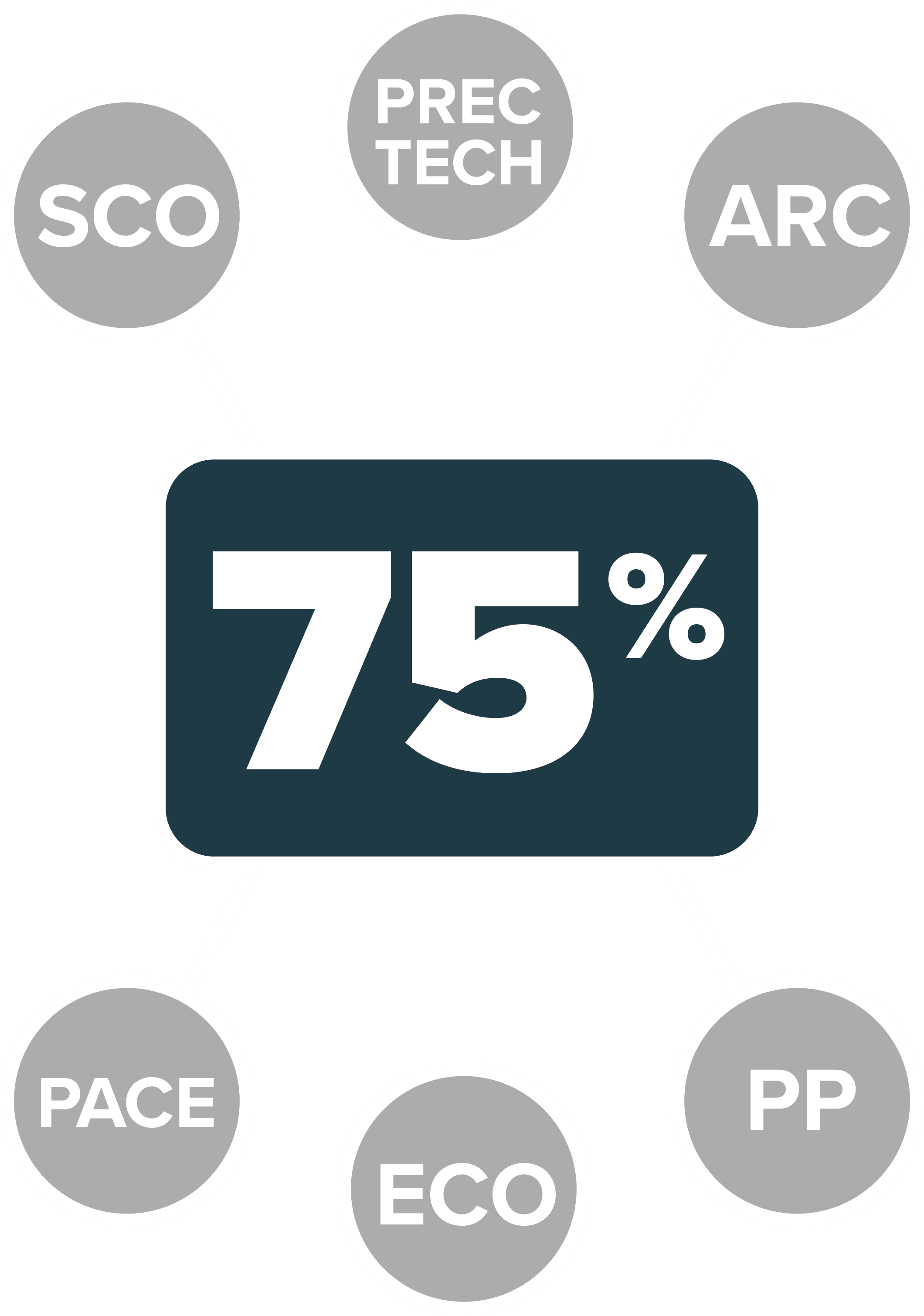

Successful farmers don’t accept standard yields or outcomes. They deserve the best, which includes risk management. Crop insurance and support programs are vast programs with millions of options. Precision Risk Management uses all those options to tailor risk plans specifically for each operation. The different programs mix to maximize guaranteed revenue while reducing premium.

With advanced risk management strategies, farmers set a floor for their revenue. Tailored risk management strategies unlock new possibilities for growers.

Benefits of a Better Crop Insurance

Forward Marketing

Farmers need to think about the future and capitalize when prices are at their highest. A robust risk management strategy allows farmers to have better forward marketing knowing they have secure guaranteed revenue.

Aggressive Decision- Making

Most decisions on large operations come with a large amount of risk. There is never enough capital to do everything that is needed or wanted. With better crop insurance, decisions requiring large capital expenditures have reduced risk. Farmers can make more aggressive operational decisions knowing a revenue stream will be there regardless of a disaster year.

Long-Term Planning

Stop farming year to year. A long-term risk management plan creates stability and success. Every operation has different risks and liabilities. A one-year plan does not adequately address long-term threats to an operation. Better crop insurance is designed to create a foundation of security for the operation.