Crop Insurance

Done Better.

Successful operations can’t settle for average. They need better crop insurance and more services.

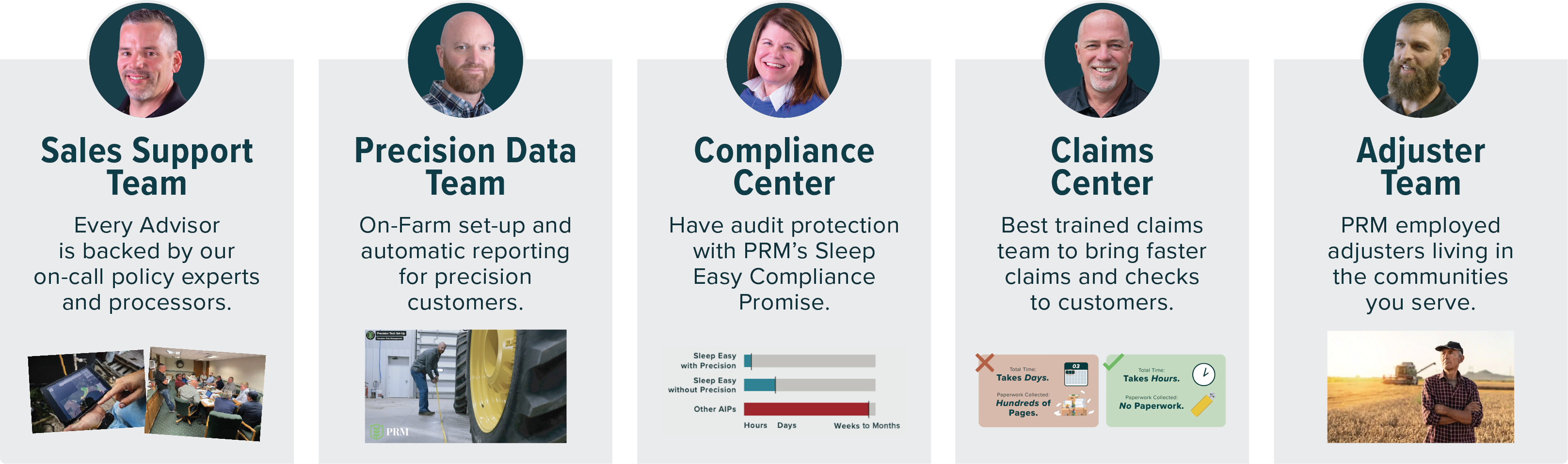

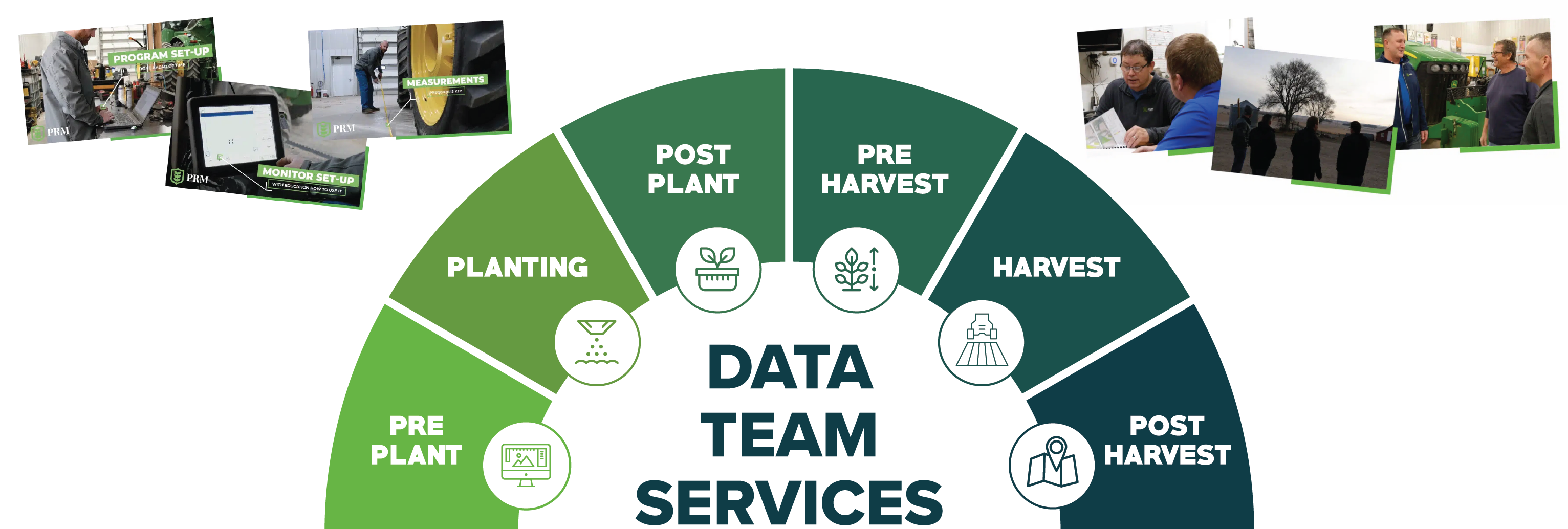

Precision Risk Management uses our unique direct-to-customers model, employing our team members, to provide better service to our customers. Only PRM can provide better crop insurance.