Skyrocketing input costs have caused a lot of uncertainty they will cut into profits of operations. Margin Protection crop insurance plans were hot topics in September when the input prices were nowhere near where they stand in May. Today, if trends continue, these unprecedented increases in input costs may cause a Margin Protection plan to create a loss claim for farmers this season.

Margin Protection, also called MP, guarantees you will maintain your desired operating margin. It covers against an unexpected decrease in operating margin (revenue less input costs). Margin Protection provides both yield and price protection meaning lower county yields, reduced commodity prices, and increased prices of inputs such as fertilizer can all lower your operating margin enough to cause a payout. It is one of the few crop insurance products to partially protect from rising costs of urea, DAP, diesel, and interest.

Input Costs Can Cause MP Loss Payment

In a PRM analysis, we are projecting Margin Protection plans may give loss payments based on the rising input cost alone. PRM held all factors the same from Spring to Fall when indemnity payments are calculated besides the increased input costs. In this SD county example, a $56.14 indemnity is owed to the farmer.

The input costs have increased more than most experts predicted. Urea is up 68%, DAP 53%, and diesel 81%. These costs cut deep into the revenue of the operation when you look at the cost per acre in our example county. Urea has a $51.25 per acre difference per acre.

Comparison of Input Cost Per Acre

Input Costs Can Cause MP Loss Payment

There are many factors in the calculations when a loss payment happens. Input costs are one small portion of it and are usually not the main cause of a loss. For the input costs alone to cause a loss payment, it shows you how unprecedented this situation is. To read a breakdown of how the loss is calculated you can read it here.

One of the typical main drivers of a loss is county yield. Margin Protection is an area-based coverage looking at the county yields, not the specific grower’s yields. If county yields go up, they have a large potential to reduce or eliminate the indemnity payment for MP. The higher county yields would increase the margin portion of the MP policy. The more revenue for the county the lower likelihood of a loss payment regardless of high input costs.

One large drawback to an MP policy is the delay to know what county yields were. The county yields are not set by the Risk Management Agency (RMA) until June of the following year. No loss payments can be calculated until that date. That means a long wait time for any indemnity payments for growers under a Margin Protection policy.

How Higher Commodity Prices Affect the MP Policy

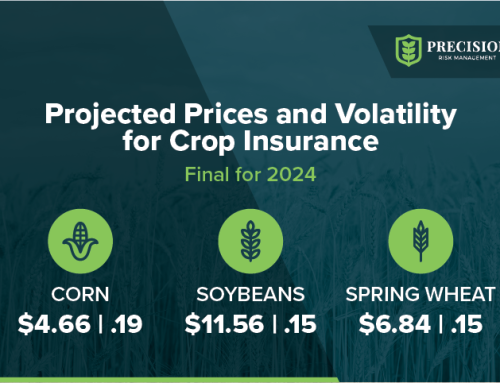

In addition to the county yields, the commodity prices determine the margins in the policy. The higher commodity prices increase revenue and make a loss payment less likely. The base prices were set at $5.06 for corn. In early May 2022, current commodity prices are significantly higher and may bump out any chance of an MP payment.

Most farmers have a secret weapon against rising commodity prices with MP—Harvest Price Option. If growers selected the Harvest Price Option, the lower base price becomes irrelevant. This option takes the harvest price set on 10/31 and replaces the base price. The margins and revenues are not affected at all by a higher commodity price. This means a grower is protected against commodity price increases and is more likely to have a loss payment. Precision Risk Management recommended for most growers buying a Margin Protection policy also take the Harvest Price Option.

The Right Partner

There are many moving parts to not only Margin Protection but all the other crop insurance products and farm programs. It is vital to have the right partner to guide you in creating a plan. Precision Risk Management provides our customers with a full crop insurance risk management strategy tailored specifically for their operation. Every operation has different needs and requires a different strategy. If you would like to contact a PRM Risk Management Advisor to see how they can help your operation, you may contact them here.

Not all coverage or products may be available in all jurisdictions. The description of coverage in this document is for informational purposes only. Actual coverage will vary based on the terms and conditions of the policy issued. The information described herein does not amend, or otherwise affect, the terms and conditions of any insurance policy issued by Church Mutual S.I. Insurance Company. PRM is an equal opportunity employer. Not all coverage or products may be available in all jurisdictions. The description of coverage in this document is for informational purposes only. Actual coverage will vary based on the terms and conditions of the policy issued. The information described herein does not amend, or otherwise affect, the terms and conditions of any insurance policy issued by Church Mutual S.I. Insurance Company. PRM is an equal opportunity provider. All marketing materials are owned and copywritten by Precision Risk Management. Any unauthorized use is prohibited.