What It Is

Main Details

Margin Protection, also called MP, guarantees you will maintain your desired operating margin. It covers against an unexpected decrease in operating margin (revenue less input costs). Margin Protection provides both yield and price protection meaning lower county yields, reduced commodity prices, increased prices of inputs such as fertilizer can all lower your operating margin enough to cause a payout.

Federally Re-Insured: Margin Protection is not a private insurance product. It is subsidized by the federal government by around 50%.

Area Based Coverage: Margin Protection is based on the county level of expected revenue. This means the coverage payout is not determined by the individual grower’s performance, but by all their neighbors’ combined performance. A well-performing grower can still receive a loss payout under this policy depending on their county.

Stand-Alone Policy: This type of coverage can be bought by itself. Many growers do pair this coverage with a Yield Protection or Revenue Protection policy.

Must be Bought Before 9/30: The Sales Close Date is 9/30 for Margin Protection.

How is Payout Calculated?

Margin Protection is one of the more complicated coverage options in determining when a payout will be determined. We will look at it from a high level for illustration purposes.

Expected Margin with deductible – Harvest Margin = Margin Loss

Margin Loss X Coverage Protection Factor = Indemnity Payout

This is a simplification of the multiple-step indemnity calculation. For a more detailed explanation, please reach out to your Risk Management Advisor.

Benefits

Up to 95% Levels: Coverage starts at 70% up to 95%. This is higher than the maximum 85% of multi-peril policies such as Yield Protection.

Input Coverage: Protects the grower from increased costs outside of the grower’s control.

Create a Floor of Revenue: Depending on the performance of the county, a grower has a safe level of revenue for the crop season. A Margin Protection payout can exceed $1,000 per acre.

Can Lock in Prices Now: Commodity prices are currently higher than average. A grower can lock in high expected commodity prices when they purchase the policy.

Premium Credit: When a grower purchases a Yield Protection or Revenue Protection policy, there is a discount on Margin Protection. This is because there are coverage overlaps.

Drawbacks

More Premium: The more coverage a policy adds, the more in premium will be owed. It will be up to the individual grower to determine if the premium fits their risk management strategy.

No Catastrophic Level of Coverage is Available

Not all Crops and States/Counties Have Coverage Options: The USDA’s site has a list of all crops and states availability found here.

Your Neighbor’s Situation can be Very Different than Yours: There can be a lot of variability in a county and Margin Protection is area-based.

Margin Protection vs ECO

Margin Protection and Enhanced Coverage Option (ECO) are two add-on policies that look very similar. When determining which one, if any, option is the best for you, please reach out to a Risk Management Advisor.

| Margin Protection | ECO | |

|---|---|---|

| Coverage Type | Area-Based | Area-Based |

| Coverage Level | Up to 95% | Up to 95% |

| Works in Conjunction with Underlying Policy? | Yes | Yes |

| Covers Input Cost Risk? | Yes | No |

| Payment Offset | Yes. Payment will be calculated with underlying policy. | No. Full payment regardless of underlying policy. |

| Covered Risks | Yield, Price, and Operating Margin | Yield and Price |

| Commodity Price Date | September 15th | February 28th |

Detailed Example of Possible Scenario

Precision Risk Management’s Policy Support Team modeled a potential scenario based on trends from previous crop years to illustrate how an MP policy would work. A grower in South Dakota buys a 2022 Margin Protection Policy with 95% coverage level and a 120% protection factor for non-irrigated corn. In this example, the commodity price will drop 22.3% like it did in 2013. The indemnity payout would be $220.86 per acre, in this South Dakota county.

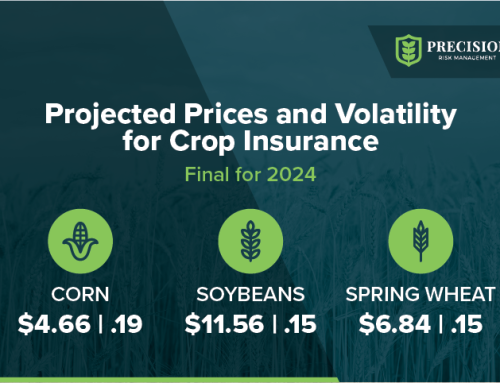

| Projected Crop Price | $5.07 | Still in Price Discovery Final 9/15 |

|---|---|---|

| Expected County Yield | 184.70bu | RMA Yields |

| Expected Revenue | $936.43 | Projected Price x Expected Co. Yield |

| Expected Cost Per Acre | $397.07 | Fixed Cost + Diesel, Urea, DAP, Potash, Interest |

| Expected Margin Per Acre | $539.36 | Expected Revenue – Expected Cost |

| $ Amount of Insurance Per Acre | $1,067.53 | Expected Revenue x Protection Factor x Coverage |

| Trigger | $492.54 | Expected Margin – (Expected Revenue x 1- Coverage Level) |

| Harvest Price | $3.82 | |

| Harvest County Yield | 184.70bu | RMA Yields |

| Harvest Revenue | $705.55 | Harvest Price x Harvest Co. Yield |

| Harvest Cost Per Acre | $397.07 | Fixed Cost + Diesel, Urea, DAP, Potash, Interest |

| Harvest Margin Per Acre | $308.48 | Harvest Revenue – Harvest Cost |

| Trigger | $492.54 | Expected Margin – (Expected Revenue x 1- Coverage Level) |

| Indemnity | $220.86 | Trigger Margin – Harvest Margin x Protection Factor |

PRM-Infographic

Precision Risk Management is an equal opportunity provider. In accordance with Federal law and U.S. Department of Agriculture (USDA) civil rights regulations and policies, the USDA, its Agencies, offices, and employees, and institutions participating in or administering USDA programs are prohibited from discriminating on the basis of race, color, national origin, religion, sex, gender identity (including gender expression), sexual orientation, disability, age, marital status, family/parental status, income derived from a public assistance program, political beliefs, or reprisal or retaliation for prior civil rights activity, in any program or activity conducted or funded by USDA (not all bases apply to all programs).Precision Risk Management is an equal opportunity provider. In accordance with Federal law and U.S. Department of Agriculture (USDA) civil rights regulations and policies, the USDA, its Agencies, offices, and employees, and institutions participating in or administering USDA programs are prohibited from discriminating on the basis of race, color, national origin, religion, sex, gender identity (including gender expression), sexual orientation, disability, age, marital status, family/parental status, income derived from a public assistance program, political beliefs, or reprisal or retaliation for prior civil rights activity, in any program or activity conducted or funded by USDA (not all bases apply to all programs).