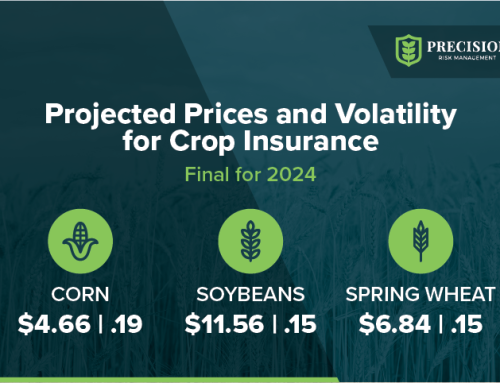

Corn and Soybean crop insurance cost projections are between 30-45% higher in 2021 compared to last year’s premium. Base prices for corn and soybeans are trending to be around $1 higher for 2021. Precision Risk Management found in a crop insurance projection analysis the increased base price and increased volatility factor can have a significant impact on coverages and overall profitability to a growers’ operation.

Many growers are at risk of higher premiums and paying for an inefficient risk management policy since 45% of policies do not change year to year. With the significant price increase from 2020, a grower’s crop insurance policy needs to be reviewed and potentially restructured to the agriculture landscape of 2021. PRM found that no changes to last year’s policy structure can have significant impacts on the overall premium paid, minimum revenue guarantee, and profitability.

Corn premiums may be 30-40% higher while soybean premiums 40-45% higher in 2021. These prices will affect most insurance plans regardless of which protection the grower has chosen. While the higher commodity prices are easy to see how it relates to a higher premium, commodity price volatility also plays a large role. Volatility means there were larger swings between the daily commodity prices resulting in uncertainty. The more uncertainty, the higher the premium price.

The higher crop prices and volatility factor will create higher premiums, but they also create an opportunity for better risk management for savvy growers. At every coverage level there will be better minimum guarantees in 2021. With Revenue Protection, the higher commodity price is directly proportional to a higher minimum revenue guarantee. Simply put, it is better coverage.

PRM found a grower would be able to lower the coverage levels to offset the increased premiums levels and still get relatively the same amount of minimum revenue guarantee. This is one possibility of the available options to pivot from the high crop prices, but it is not the proper risk management solution for everyone. Every operation is different with different levels of risk tolerance and goals. The crop insurance policy has to be changed and custom-fit each year to the operation and the needs of that year to create the best risk management strategy.

There is no one solution fits all for crop insurance. Each operation has its own characteristics. A trusted advisor needs to examine the specifics to create a tailored solution. One of the worst options to risk management could be continuing a crop insurance policy without understanding the consequences. Please call an PRM agent soon.