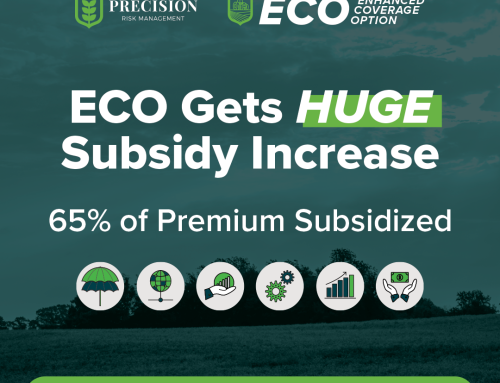

Enhanced Coverage Option (ECO) is a unique crop insurance product to protect the top end of a grower’s yield or revenue. This coverage, up to 95%, comes with a real premium cost along with very defined circumstances to cause a loss payout. It will be a great option for some growers and not worth the cost to others.

For 2022, there are no program changes from the previous year. That does not mean ECO should be looked at or bought exactly like it was in 2021. Every good risk management strategy adjusts to that year’s circumstances. 2022 is looking to be a highly volatile and unpredictable year. Precision Risk Management arms the grower with the knowledge to know what they are buying and why. We will not push products for the sake of a sale. In this analysis, PRM will provide the full picture of ECO so the grower can choose what is right for them

ENHANCED COVERAGE OPTION BASICS

Enhanced Coverage Options is an endorsement that provides insurance coverage to the top end of county revenue losses between 86% to 90/95%. Crop Insurance can be thought of in tiers. The base tier is the Multiple Peril Crop Insurance (MPCI). This tier has the choice of coverages such as Revenue Protection and Yield Protection.

The next tier will cover up where the MPCI coverage ends up to 86% of losses.

Enhanced Coverage Option covers 86% to either 90% or 95% of county revenue, depending on which level of coverage the grower selects. To read the full basics of ECO click here.

WHAT IT TAKES FOR AN ECO LOSS IN 2022

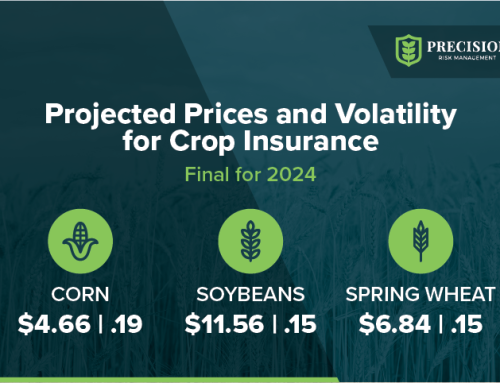

When base commodity prices are set in February, they are projected to be at record levels again. It is a high starting point that creates a potential for a large loss if prices drop. An ECO policy protecting the 86% to 90/95% levels could potentially be very attractive.

Let’s look at an example. A combination drop in yield and price can lead to a payout, but we will look at these two independently in our example for simplicity.

*Every policy, county, and operation are unique. This is one example to illustrate the ECO product. A Risk Management Advisor can provide a quote based on a specific operation.

We will start with a corn base price of $5.38, the Texas base price just set. This grower’s expected county yield is 184.7 and expected revenue of $993.69 per acre.

ECO Coverage at 95% level:

Prices need to fall below $5.11 or the county yield below 175.5 to start a loss situation. The further the price or yield drops the larger the loss claim will be. This upper-end coverage comes with a $34.31 per acre premium. In this example, the premium is very high compared to other products.

ECO Coverage at 90% level:

Prices need to fall below $4.78 or the county yield below 166.2 to start a loss situation. The larger the drop in coverage also comes with a large reduction in premium to $10.68 per acre.

IS THIS LIKELY?

There is no way to predict what the prices or yields will be. A grower needs to choose if and how much they think prices will drop. It is also important to remember ECO is a county-based product. A grower’s individual revenue will not determine a loss payout.

HOW TO DECIDE WHAT IS RIGHT FOR THE GROWER

The key to an operation’s success is a deep analysis of the options available. These programs and products can and should be shuffled around each year. PRM’s Risk Management Advisors will partner with the operation to help find the best coverage mix based on their needs and risk tolerance.

If a grower is interested in ECO, SCO, ARC, or PLC a PRM Advisor would like to discuss if it is the correct fit for the operation.

Not all coverage or products may be available in all jurisdictions. The description of coverage in this document is for informational purposes only. Actual coverage will vary based on the terms and conditions of the policy issued. The information described herein does not amend, or otherwise a ect, the terms and conditions of any insurance policy issued by Church Mutual S.I. Insurance Company. PRM is an equal opportunity provider